Crypto Exchange Risk Checker

Check Exchange Legitimacy

Red Flags Found

Safe Alternatives

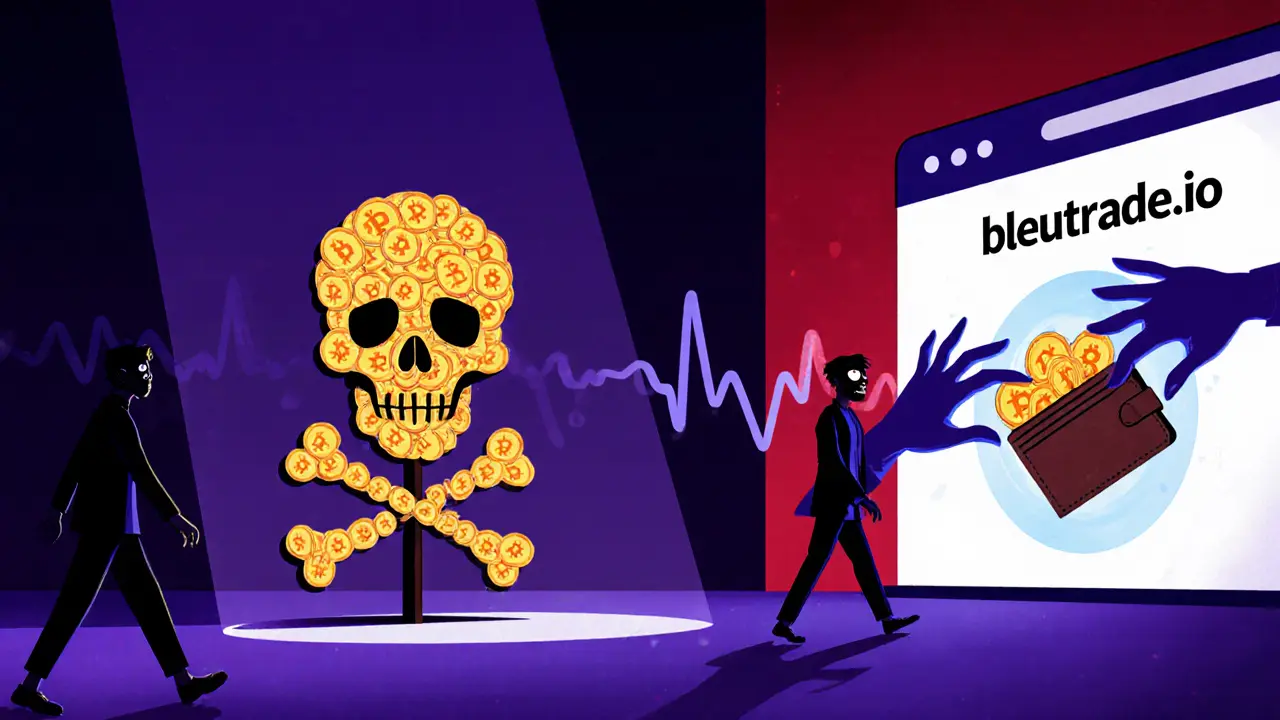

Back in 2014, Bleutrade launched with a simple promise: trade obscure altcoins that bigger exchanges ignored. It sounded like a dream for speculative traders looking for the next big thing. But by 2025, Bleutrade isn’t just outdated-it’s dead. Or worse, it’s a scam.

What Was Bleutrade?

Bleutrade was a cryptocurrency exchange that focused almost entirely on altcoins-small, low-volume tokens like DASH, LTC, DOGE, and dozens of others no one remembers today. Unlike Binance or Coinbase, it didn’t support USD, EUR, or any fiat currency. You couldn’t buy Bitcoin with a credit card. You had to already own crypto and transfer it in. That made it useless for beginners but appealing to a small group of traders chasing risky, low-liquidity coins.

The platform itself was basic. No advanced charts. No margin trading. No mobile app. Just a simple interface with order books, trade history, and price graphs. It looked like something built in 2014 and never updated. Users said the UI was easy to use, but that’s like saying a flip phone is easy to use-it works, but it’s not built for today’s world.

Trading Fees and Withdrawals: The Only Thing That Made Sense

Bleutrade’s fee structure was actually normal for its time: 0.25% for both makers and takers. Bitcoin withdrawals cost 0.001 BTC-a rate that matched industry standards back then. On paper, it looked fair. But here’s the catch: fees only mattered if you could actually get your money out.

Multiple reports from 2017 onward show users couldn’t withdraw funds. Not because of technical glitches. Not because of high traffic. Because they were asked to pay "verification fees," "taxes," or "processing charges" before their withdrawals would go through. And once they paid? The money vanished. No response. No refund. No explanation.

StaySafeWeTrace, a fraud monitoring site, called it an "Advance Fee Scam"-a classic red flag. ScamAdviser gave bleutrade.io a "very low trust score" based on hidden ownership, lack of SSL history, and user complaints. Trustpilot reviews from 2017-2018 averaged just 1.8 out of 5 stars, with 78% of users citing withdrawal issues as their main complaint.

Why Bleutrade Failed

Bleutrade’s downfall wasn’t bad luck-it was bad business.

- Too many "crap coins": ForexSQ users called its altcoin list a graveyard of worthless tokens. As major exchanges added hundreds of altcoins themselves, Bleutrade’s niche disappeared.

- No liquidity: By 2019, its 24-hour trading volume dropped from $1.2 million to just $38,000. When no one’s buying, your market dies.

- No updates: While competitors added mobile apps, OTC desks, and staking, Bleutrade stayed frozen in 2014.

- No regulation: It claimed to be based in Malta, then Brazil, then nowhere. No clear legal structure. No compliance. That’s a red flag for any serious exchange.

By 2022, CryptoSlate listed Bleutrade among "Dead Exchanges"-platforms that either shut down or turned into scams after failing to adapt. Myfxbook now classifies it as a "Closed Crypto Exchange." The website still loads, but the trading engine is offline. The support tickets? Never answered.

Who Was Bleutrade For?

Only one kind of trader ever benefited: someone who already had crypto, didn’t care about security, and wanted to gamble on coins with zero market cap. Even then, the risk was huge. You weren’t just betting on a coin-you were betting that the exchange wouldn’t vanish with your funds.

For everyone else? It was a trap. New users couldn’t buy in. Experienced users couldn’t get out. And the longer you waited, the more likely you were to get caught in an advance fee scam.

What Happened to the Website?

As of 2025, bleutrade.io still exists. The homepage still lists trading pairs. The login page still works. But if you try to deposit, you’ll be asked to send crypto to a wallet that’s likely controlled by scammers. If you try to withdraw? You’ll get a message asking for a "processing fee." That’s the scam in action.

There’s no customer service. No email replies. No social media activity since 2019. The domain is registered under privacy protection. The company behind it? Untraceable. The platform? Functionally dead.

What You Should Do Instead

If you’re looking to trade altcoins today, there are better, safer options:

- Binance: Supports over 300 coins, low fees, strong security, and fiat on-ramps.

- Kraken: Regulated, transparent, and trusted by institutions.

- KuCoin: Strong altcoin selection, good liquidity, and user-friendly.

These platforms have real customer support, two-factor authentication, insurance funds, and clear regulatory compliance. They don’t ask you to pay to get your own money back.

Final Warning

Bleutrade is not a failed exchange-it’s a cautionary tale. It shows how quickly a once-promising platform can turn into a fraud when it ignores security, regulation, and user trust. Don’t be fooled by the fact that the website still loads. That doesn’t mean it’s operational. It just means someone’s still hosting it to catch the next victim.

If you ever hear someone say, "Oh, I used Bleutrade back in the day," don’t ask for trading tips. Ask them how they got their money out. Chances are, they didn’t.

Is Bleutrade still operating as a crypto exchange?

No. Bleutrade is no longer operational as a functioning exchange. While the website may still load, trading has been inactive for years. Multiple sources, including Myfxbook and CryptoSlate, classify it as a closed or defunct exchange. Any activity on the site now is likely part of a scam designed to trick users into sending crypto.

Can I withdraw my funds from Bleutrade today?

If you still have funds on Bleutrade, you almost certainly cannot withdraw them. Reports from 2017-2022 show users were blocked from withdrawals unless they paid fake "fees" or "taxes." Once paid, those fees were never refunded, and the funds disappeared. The platform has no working support system, and there is no known way to recover lost assets.

Was Bleutrade ever regulated?

There is no credible evidence Bleutrade was ever properly regulated. While CoinCodex listed Malta as its base, no official registration under Malta’s Digital Innovation Authority (MDIA) has been verified. Other sources claimed it was based in Brazil, but no Brazilian financial authority ever recognized it. The lack of clear jurisdiction and compliance made it a high-risk platform from the start.

Did Bleutrade offer fiat currency deposits?

No. Bleutrade only allowed crypto-to-crypto trading. You could not deposit USD, EUR, or any other fiat currency. This meant new users had to buy crypto elsewhere first-like on Coinbase or Kraken-and then transfer it over. This made it inaccessible for beginners and limited its user base to experienced traders.

Why did users complain about "crap coins" on Bleutrade?

Bleutrade listed hundreds of obscure, low-value altcoins with little to no trading volume. Many were created just to be listed on the exchange, with no real development team or use case. Users called them "crap coins" because they had no liquidity, no future, and often disappeared after being listed. This attracted speculators but drove away serious traders who wanted reliable markets.

Is Bleutrade a scam?

Yes, based on overwhelming evidence. StaySafeWeTrace and ScamAdviser both classify Bleutrade as a scam platform. The pattern of asking users to pay withdrawal fees before accessing their own funds is a textbook advance fee scam. Multiple Reddit and Trustpilot reports confirm users lost money this way. Even if the exchange once operated legitimately, it transitioned into fraud years ago.

Should I ever use Bleutrade today?

Absolutely not. Even if the site appears active, it is not safe. Depositing any cryptocurrency now will likely result in permanent loss. There is no legitimate trading activity, and any interaction with the platform carries a high risk of fraud. Treat it as a digital graveyard-not a marketplace.

What to Do If You Lost Money on Bleutrade

If you sent crypto to Bleutrade and can’t get it back, there’s no recovery path. No government agency, no exchange, no lawyer can retrieve funds from a scam like this. Your only option is to cut your losses and learn from it.

Never send money to any platform that asks for fees to release your own funds. That’s never normal. Always use regulated exchanges with clear terms, verified support, and public track records. And if something looks too good-or too easy-to be true? It probably is.

Arthur Coddington

November 11, 2025 AT 20:36Bleutrade wasn't just a failed exchange-it was a graveyard for crypto dreams. People still post about it like it's some lost relic, but the truth is, it was always a house of cards built on altcoins no one cared about and withdrawal fees that were just scams in disguise.

Joy Whitenburg

November 12, 2025 AT 04:30so many people lost everything on that site... i still cringe thinking about it. if you ever see someone say 'oh i used bleutrade', just hug them and say 'you're safe now'.

no fees. no lies. just peace.

Raymond Day

November 13, 2025 AT 01:27THIS IS WHY YOU DON'T TRUST ANONYMOUS EXCHANGES!!

Look at the domain registration-privacy protected since 2016. No SSL history. Zero regulatory footprint. And yet people still try to 'withdraw'??

It's not a glitch. It's not a 'technical issue'. It's a digital mugging. The site is a ghost town with a neon sign that says 'SEND CRYPTO HERE'.

And the worst part? It's still online. Still catching new victims. This isn't history. This is an active predator.

Stephanie Platis

November 13, 2025 AT 11:48Let us be clear: the term 'exchange' was never accurate. Bleutrade was a Ponzi architecture disguised as a marketplace. The platform's refusal to implement basic KYC, its opaque ownership structure, and its systematic solicitation of 'processing fees' constitute a textbook violation of fiduciary duty-and, arguably, criminal fraud under U.S. wire fraud statutes. The fact that it persists online is not negligence; it is malice.

Michelle Elizabeth

November 14, 2025 AT 04:54It’s funny how people romanticize the early days of crypto. Like, 'Oh, back then, it was pure!' No. Back then, it was the Wild West-and Bleutrade was the saloon where the bartender slipped you a drugged whiskey and stole your boots while you passed out.

I used to trade there. I lost everything. I don’t miss it. I miss the person I was before I trusted a website that looked like it was coded in Notepad.

Phil Bradley

November 16, 2025 AT 04:41People forget that crypto didn't start with billion-dollar exchanges. It started with people trading on forums, on shady sites, on platforms that looked like they were built by a high schooler with a dream and a GitHub account.

Bleutrade was that dream. And like most dreams from 2014? It got crushed under the weight of reality. But here’s the twist-it didn’t die. It evolved. Into something worse. A ghost that still whispers to the desperate: 'Just one more fee... and your coins will be free.'

It’s not a scam. It’s a ritual. And we’re all still dancing around the fire.

Diana Dodu

November 18, 2025 AT 00:14USA had the best crypto regulators, and yet this garbage lived for over a decade? No wonder the world thinks we're all naive. If this had happened in Germany or Japan, the entire team would be in prison by now. But here? We let it fester because 'free markets' and 'innovation' are code for 'no one's watching.'

And now? It's a museum piece. A monument to American crypto arrogance.

Atheeth Akash

November 18, 2025 AT 18:07i used bleutrade in 2015. i sent 0.5 btc. never got it back.

but i learned something: dont trust anyone who says 'just pay small fee to unlock'.

now i only use binance. safe. simple. no drama.

rest in peace, bleutrade. you were never worth it.

Kylie Stavinoha

November 18, 2025 AT 19:14There is a profound irony in how we mourn the fall of platforms like Bleutrade. We treat them like fallen prophets-figures who promised liberation through decentralization, yet delivered only exploitation.

But perhaps the real tragedy isn't the scam-it's that we kept returning. We kept believing that the next altcoin, the next 'low-fee' exchange, the next 'underdog' platform would be different. We mistook desperation for discernment.

And so we built a culture where trust was currency-and the only thing we ever traded was hope.

Maybe the real lesson isn't about Bleutrade.

It's about us.

James Ragin

November 18, 2025 AT 22:35Let’s not pretend this was just a rogue exchange. The fact that it operated for over a decade without being shut down by the SEC, the DOJ, or any federal agency suggests complicity. Someone knew. Someone allowed it. Maybe even someone profited.

Think about it: why does the domain still resolve? Why is there no takedown order? Why do the WHOIS records remain hidden? This isn't incompetence. This is systemic. The entire crypto regulatory framework is a farce. And Bleutrade? It was just the canary in the coal mine.

They let it die slowly... so they could watch how many people would still jump in.

Noriko Yashiro

November 20, 2025 AT 12:05I still remember logging into Bleutrade back in 2016. The interface was clunky, the coins were wild, but I thought 'Hey, this is the frontier!'

Turns out, the frontier was just a trapdoor.

Now I use Kraken. No drama. No fees to withdraw. Just clean, quiet trading.

Don't be like me. Don't wait until you've lost everything to learn the hard way.

tom west

November 21, 2025 AT 11:07It is not merely inaccurate to refer to Bleutrade as a 'failed exchange'; such a characterization fundamentally misrepresents the nature of its operations. The entity functioned as a predatory financial instrument designed to extract capital from retail participants under the guise of market access. Its fee structure, while superficially aligned with industry norms, was a mechanism for entrapment-leveraging the psychological bias of loss aversion to compel users to remit additional funds under the false pretense of withdrawal authorization.

Furthermore, its persistent online presence, devoid of any functional trading infrastructure, constitutes a form of digital baiting-a modern iteration of the Nigerian prince scam, algorithmically optimized for crypto-native demographics. The lack of regulatory oversight, the absence of verifiable corporate registration, and the total absence of responsive customer service are not anomalies-they are the operational parameters of a criminal enterprise.

It is unconscionable that such platforms are allowed to remain accessible, especially when they continue to serve as vectors for financial predation. The fact that the domain remains active, and that users still attempt to interact with it, demonstrates a catastrophic failure of investor education, regulatory enforcement, and digital literacy.

Moreover, the normalization of such platforms within crypto discourse-where 'back in the day' nostalgia overrides rational risk assessment-reveals a deeper cultural pathology. We romanticize failure. We glorify risk. We mistake recklessness for innovation. And in doing so, we enable the very systems that prey upon us.

Let this not be a cautionary tale. Let it be a monument. A monument to the consequences of blind trust in unregulated systems. And let it serve as a warning: if a platform does not have a clear legal domicile, a verifiable team, and a functional support channel-it is not an exchange. It is a vault with no door, and you are the one holding the key.