Russia Crypto Risk Calculator

Risk Assessment

By 2025, Russia doesn’t just limit cryptocurrency-it controls it. If you’re in Russia and want to use Bitcoin, Ethereum, or any other decentralized coin, you’re walking a tightrope. The government doesn’t want you trading crypto for everyday purchases. It doesn’t want you sending money abroad using wallets. And it definitely doesn’t want you bypassing the ruble. But here’s the twist: crypto isn’t banned outright. It’s just locked behind a door only a few are allowed to open. And that door? It’s called the Experimental Legal Regime.

What You Can’t Do (And What Happens If You Try)

If you’re an ordinary Russian citizen, here’s what’s off-limits:- Buying or selling crypto on local exchanges-most are shut down or frozen.

- Using crypto to pay for goods or services inside Russia-this triggers automatic bank alerts.

- Peer-to-peer (P2P) trades through apps like LocalBitcoins or Paxful-your bank account can be frozen within hours.

- Mining without a license-fines start at 200,000 rubles ($2,200) and can lead to criminal charges.

What You Can Do (The Legal Backdoor)

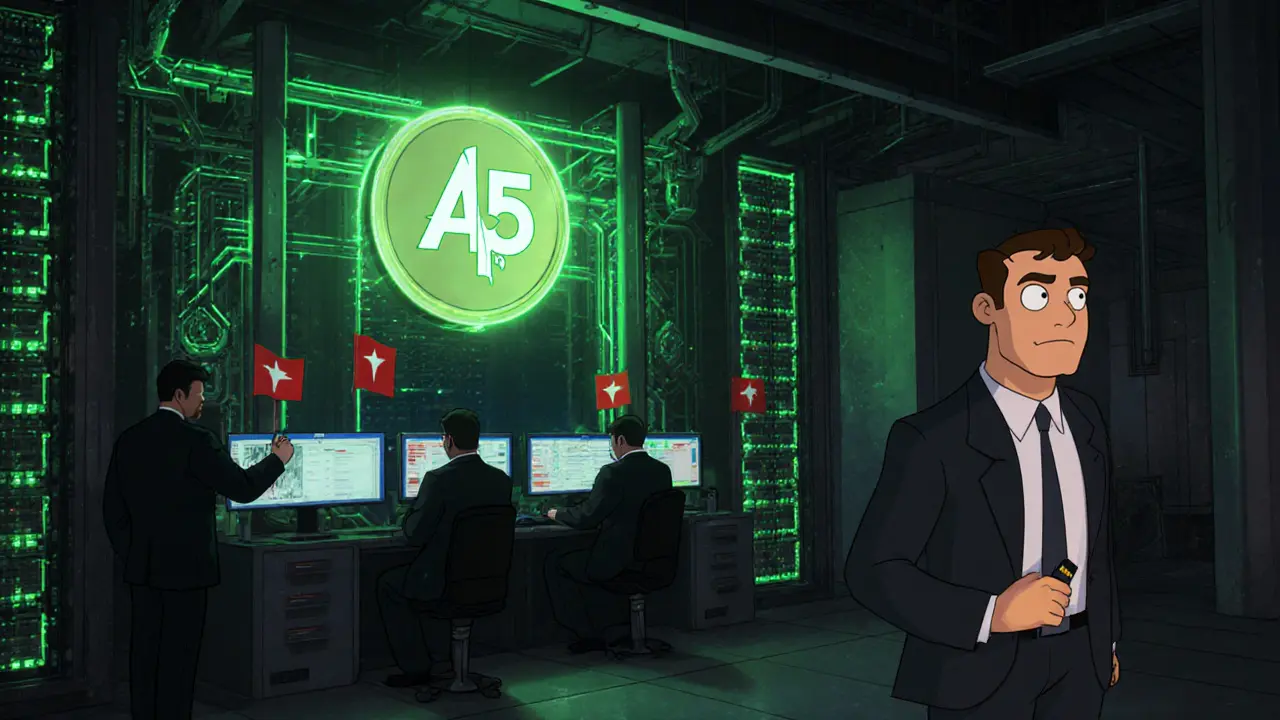

There’s one legal path-and it’s not for regular people. It’s called the Experimental Legal Regime (ELR) a state-sanctioned framework allowing select companies to use cryptocurrencies for cross-border trade under strict government oversight. This isn’t about buying Bitcoin to save money. It’s about Russian exporters shipping oil, metals, or grain to countries like China, India, or Turkey, and getting paid in crypto to bypass Western sanctions. Only about 300 companies in Russia are approved for ELR. They must register with the Central Bank, prove their business is legitimate, and report every crypto transaction. The coins they use? Mostly Bitcoin and Ethereum-but only as settlement tools. Not for spending. Not for saving. Just for moving money across borders. The real star of ELR? A7A5 a ruble-backed stablecoin issued by a state-aligned entity, used for international settlements to avoid SWIFT restrictions. In July 2025 alone, A7A5 processed $41.2 billion in transactions. It’s not traded on public exchanges. You can’t buy it. Only approved entities can mint and use it. It’s Russia’s answer to USDT-but fully controlled by Moscow.How Ordinary Russians Get Crypto (The Gray Zone)

Most Russians who use crypto aren’t following the law. They’re working around it. Here’s how:- Foreign exchanges: Platforms like Binance, Kraken, and Bybit remain accessible in Russia, though they’re technically blocked. Users access them via VPNs. Many use these to buy crypto with rubles via P2P-despite the risk.

- Gift cards and cash trades: Some buy crypto through Telegram groups where people trade gift cards (Steam, Amazon) for Bitcoin. Others meet in person to exchange cash for crypto wallets-though this is risky and often monitored.

- Foreign bank accounts: Russians with access to accounts abroad (often through relatives or offshore structures) use them to buy crypto on international platforms, then transfer it back to Russian wallets.

The Digital Ruble: The Endgame

Russia isn’t trying to ban crypto because it hates technology. It wants total control. That’s why the digital ruble a central bank digital currency (CBDC) being rolled out in 2026 to replace cash and restrict private crypto use is coming in 2026. Unlike Bitcoin, the digital ruble will be fully traceable. Every transaction will be logged by the Central Bank. No anonymity. No bypassing. No foreign wallets. The goal? Replace crypto as a store of value and payment tool with a government-approved version. Once it’s live, using Bitcoin to send money to your cousin in Turkey could become a criminal act. The digital ruble will be the only legal digital currency for most Russians.What Experts Say About the Future

There’s tension inside the Russian government. The Ministry of Finance Russian government agency advocating for broader crypto access to support economic growth and innovation wants to open crypto to more investors. They see it as a tool for economic development. But the Central Bank of Russia Russia’s monetary authority enforcing strict controls on crypto to preserve the ruble and prevent capital flight is holding firm. They fear losing control over the financial system. Deputy Treasury head Ivan Chebeskov has publicly called for a national crypto strategy. But so far, nothing’s changed. The Central Bank still insists crypto should only exist for international trade under ELR. And even that’s shrinking. More companies are being dropped from the program. More audits are happening. More fines are being issued.

What You Should Do Right Now

If you’re in Russia and want to use crypto without getting caught:- Don’t use local exchanges. They’re either dead or monitored.

- Use a reputable foreign exchange. Binance and Kraken are still the most reliable. Avoid obscure platforms.

- Use a VPN. Don’t rely on your home internet to access crypto sites.

- Never use crypto to pay for things in Russia. Stick to holding or transferring.

- Keep small amounts. Large transfers trigger alerts. Stay under 100,000 rubles per transaction.

- Don’t mine. Even if you think you’re doing it quietly, the government has sensors everywhere.

What’s Next?

By 2026, the digital ruble will be everywhere. Cash will become harder to use. Foreign cards won’t work. Crypto will be either a criminal act or a state-controlled tool. The window for using crypto freely in Russia is closing fast. Right now, you still have options. But they’re getting riskier. The people who got rich off crypto in 2022 are now quietly moving their assets abroad. The ones who stayed? They’re watching their accounts freeze. This isn’t about freedom. It’s about control. And Russia is winning.Can I legally buy Bitcoin in Russia in 2025?

You can’t buy Bitcoin legally through Russian exchanges-they’re banned. But you can buy it through foreign platforms like Binance using a VPN. However, this exists in a legal gray zone. Your bank may freeze your account if it detects crypto-related activity. There is no legal retail market for crypto in Russia.

Is mining Bitcoin allowed in Russia?

Mining is the only crypto activity with a clear legal path-but only if you’re licensed. Unlicensed mining carries a fine of 200,000 rubles ($2,200) and possible criminal charges. Most individual miners operate illegally, risking account freezes and asset seizures.

What is the A7A5 stablecoin, and can I use it?

A7A5 is a ruble-backed stablecoin created by a state-aligned entity for international trade. It’s used by approved companies under the Experimental Legal Regime to bypass Western sanctions. Ordinary Russians cannot buy, hold, or use A7A5. It’s not available on any public exchange.

Will the digital ruble replace Bitcoin in Russia?

Yes. The digital ruble, launching in 2026, is designed to be the only legal digital currency for Russian citizens. It will replace cash, limit crypto use, and give the government full control over every transaction. Bitcoin and other cryptocurrencies will become obsolete for daily use.

Can I use crypto to send money to family abroad?

Technically, no-unless you’re part of the Experimental Legal Regime. Sending crypto abroad as an individual triggers bank monitoring and may result in account freezes. Most Russians use foreign bank accounts, gift cards, or cash transfers instead, though these carry their own risks.

Why did Garantex get shut down?

Garantex was sanctioned by the U.S. Treasury in March 2025 for processing ransomware payments and facilitating money laundering. The U.S. Secret Service seized its servers and froze over $26 million in crypto. Its operators were indicted, and its successor, Grinex, is now under similar scrutiny.

Are there any legal crypto exchanges in Russia?

No. All domestic exchanges are either closed or operating illegally. The government has not licensed any exchange for retail crypto trading. Any platform claiming to be a "Russian crypto exchange" is either a scam or operating outside the law.

Can I get fined for owning Bitcoin in Russia?

Owning Bitcoin isn’t illegal by itself. But using it to pay for goods, trade P2P, or move money through unapproved channels can trigger fines, account freezes, or criminal charges. The law targets activity, not possession.

Andy Purvis

November 11, 2025 AT 23:12So Russia's basically turning into a digital police state but calling it 'economic stability'... classic move. I mean, if you can't trust your own people with crypto, what does that say about your system? I'm just saying.

dhirendra pratap singh

November 12, 2025 AT 19:15OMG THIS IS SO TRAGIC 😭😭😭 Russia is literally killing freedom with a digital ruble 💔 I can't believe people are still living there... why not just leave???

Ashley Mona

November 14, 2025 AT 16:11Actually, this is super well-researched. I’ve been tracking the A7A5 stablecoin since last year-it’s wild how it’s quietly replacing SWIFT in Eurasian trade. The real story isn’t the ban, it’s how Russia built a parallel financial system without the West even noticing until it was too late. Also, VPNs are still your best friend if you’re in Russia. Just don’t use free ones-they’re all monitored now.

Edward Phuakwatana

November 15, 2025 AT 02:48Think about it-crypto was never about decentralization in Russia. It was always about leverage. The state didn’t ban it because they feared it-they feared what it could expose. The digital ruble isn’t the future, it’s the endpoint. A system where every transaction is logged, every movement tracked, every dollar accounted for. Welcome to the panopticon economy. 🤖💸

Suhail Kashmiri

November 15, 2025 AT 05:53People still using crypto in Russia are just asking for trouble. If you're dumb enough to risk your bank account over Bitcoin you deserve to get locked out. Grow up and use the ruble like everyone else.

Kristin LeGard

November 15, 2025 AT 08:10Let me get this straight-Russia lets 300 companies use crypto to bypass sanctions but bans regular people? Classic hypocrisy. They want the money but not the freedom. And now they’re calling it 'economic sovereignty'? Please. It’s just authoritarianism with a blockchain sticker on it.

Arthur Coddington

November 16, 2025 AT 21:26Wow. Just… wow. This is like watching a dystopian movie where the government wins and nobody even fights back. I mean, who even cares anymore? The world’s gone soft. We let this happen because we’re too busy scrolling TikTok to notice.

Phil Bradley

November 18, 2025 AT 00:36I get why people are scared, but honestly? The fact that people are still finding ways to use crypto-via gift cards, cash trades, foreign accounts-that’s the real story. Human ingenuity doesn’t die just because a government says so. There’s still a pulse out there. Just… quiet.

Stephanie Platis

November 18, 2025 AT 20:53Correction: The term is 'Experimental Legal Regime'-not 'Experimental Legal Regime' as written in the article. Also, 'A7A5' is not a stablecoin-it's a tokenized asset under the Central Bank's oversight framework. Please fact-check before publishing. This level of inaccuracy undermines credibility.

Michelle Elizabeth

November 19, 2025 AT 13:23It’s funny how people think crypto = freedom. It’s just another form of control. The digital ruble is cleaner. More efficient. Less chaotic. Maybe Russia’s onto something. Not everyone needs to be a rebel.

Joy Whitenburg

November 19, 2025 AT 21:58Okay so I just moved to Russia last year and honestly? I’ve been using Binance + a decent VPN for 8 months now. No issues. Just keep it under 50k rubles, never pay for stuff locally, and don’t mine. Also-don’t tell anyone you do this. Seriously. I’ve got a friend who got flagged for a 100k transfer. Took 3 weeks to get access back. Not worth it.

Kylie Stavinoha

November 20, 2025 AT 19:14What’s fascinating here isn’t the ban-it’s the cultural shift. In the West, crypto is a speculative asset. In Russia, it’s become a survival mechanism. The state didn’t just regulate it; it redefined its meaning. Crypto is no longer about decentralization-it’s about resilience. And that’s a quiet revolution.

Diana Dodu

November 21, 2025 AT 08:11And yet, the U.S. sanctions Garantex? That’s rich. We’ve been sanctioning crypto exchanges for years while our own banks launder money for oligarchs. Double standards are alive and well. Russia’s not the villain here-they’re just playing the game better than we are.

Raymond Day

November 21, 2025 AT 23:23THEY’RE WATCHING YOU. EVERY. SINGLE. TRANSACTION. 😱 The digital ruble is just the beginning. Next they’ll track your coffee purchases, your Uber rides, your Netflix subscriptions. Crypto was the last stand. Now? You’re just a data point with a bank account.

Noriko Yashiro

November 22, 2025 AT 10:51Actually, I think this is brilliant. If you can’t beat them, join them. Russia’s using crypto to bypass sanctions and keep its economy alive. That’s smart statecraft. The West keeps throwing tantrums while Russia builds a new financial architecture. We should be studying this-not mocking it.

Atheeth Akash

November 24, 2025 AT 06:24Been using crypto in Russia since 2022. No problems if you keep it low-key. Just use Kraken, don’t trade P2P, and never mention it to your bank. Also, A7A5 is real-my cousin’s company uses it for oil payments to India. It works. Just not for us regular folks.

James Ragin

November 24, 2025 AT 17:07This is all part of the New World Order. The digital ruble? It’s not about control-it’s about total surveillance. The Central Bank is feeding data to the same AI systems that track your social media, your phone location, your shopping habits. They’re building a single identity ledger. This isn’t finance-it’s digital enslavement. And they’re calling it 'progress'.

Michael Brooks

November 24, 2025 AT 20:28TL;DR: Don’t mine. Don’t pay with crypto. Use Binance. Use a good VPN. Keep it under 100k. Don’t tell anyone. And hope the digital ruble doesn’t come for you before you can get out.

David Billesbach

November 24, 2025 AT 22:12They’re lying. The 'Experimental Legal Regime' is just a front. The real goal is to identify every crypto user and freeze them out. The 300 companies? They’re all owned by Putin’s inner circle. This isn’t economic policy-it’s a wealth transfer. And you? You’re just collateral damage.

FRANCIS JOHNSON

November 25, 2025 AT 06:56History doesn’t repeat, but it rhymes. The Soviet Union banned private enterprise. Then came the black market. Then came the collapse. Russia’s doing the same thing-but with blockchain. The digital ruble will be their last gamble. And when it fails? The people will remember who took their freedom. Not with protests-with silence. And silence is louder than any revolution.