Privacy Coin Trading Cost Calculator

This calculator shows the cost difference between regulated exchanges and peer-to-peer (P2P) trading for privacy coins in Australia. Since Australian exchanges no longer support privacy coins, P2P platforms are the only option, but they come with significant price premiums.

Results

Enter a quantity to see the cost difference

Australians can still own privacy coins like Monero, Zcash, and Dash - but buying or selling them on local exchanges is now effectively impossible. Since early 2025, every major Australian crypto platform has removed these assets from their trading pairs. It’s not a law that says ‘you can’t hold them.’ It’s a system that makes it nearly impossible to trade them legally. And that’s the real issue.

Why Privacy Coins Got Banned

Privacy coins are designed to hide transaction details. Monero uses ring signatures and stealth addresses to scramble who sent what to whom. Zcash uses zero-knowledge proofs to prove a transaction happened without revealing any details. These aren’t bugs - they’re the whole point. But for regulators, that’s the problem. Australia’s financial watchdogs, ASIC and AUSTRAC, don’t ban ownership. They regulate exchanges. And under the Anti-Money Laundering and Counter-Terrorism Financing Act, exchanges must know who their customers are and track every transaction. Privacy coins break that rule. You can’t verify a user’s identity if you can’t see where the money came from. You can’t flag suspicious activity if the transaction history is invisible. It’s not just Australia. In 2025, 73 global exchanges delisted privacy coins - up from 51 in 2023. Binance pulled them from its US and EU platforms in February. Kraken removed them from Canada in March. Poloniex followed globally in April after pressure from the US Treasury. Australia didn’t lead this charge - it just followed the global trend.How the Ban Works in Practice

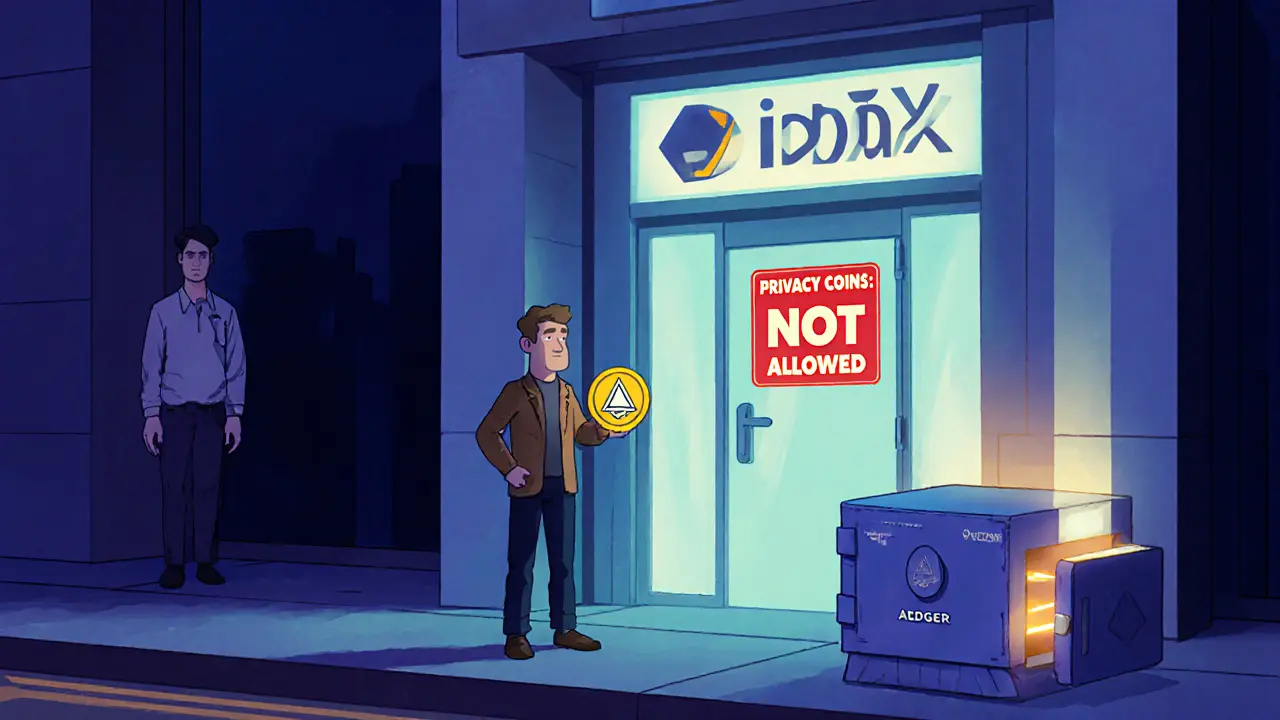

There’s no official government order saying “ban privacy coins.” Instead, AUSTRAC made it clear: if you run a crypto exchange in Australia, you must comply with AML/CTF rules - or lose your license. Exchanges chose compliance over convenience. Major platforms like Independent Digital Assets Exchange (IDAX) reported that 78% of their institutional clients supported removing privacy coins. Banks and hedge funds don’t want to touch assets they can’t trace. So exchanges removed them to keep institutional money flowing. For regular users, this means:- You can’t buy Monero on CoinSpot, Swyftx, or Independent Reserve.

- You can’t sell Zcash for AUD through any licensed Australian platform.

- Even if you already own privacy coins, you can’t cash out easily.

What You Can and Can’t Do

Here’s the reality:- You CAN: Hold privacy coins in your own wallet. Buy them overseas on unregulated platforms. Trade them privately with someone you trust.

- You CANNOT: Trade them on any Australian exchange registered with AUSTRAC. Use a crypto ATM in Australia to buy or sell them. Convert them to AUD through a licensed platform.

What’s Changing in March 2026

Right now, the ban is enforced through compliance pressure. But starting March 31, 2026, AUSTRAC will officially expand its rules to cover all digital asset service providers - not just exchanges. That includes wallet providers, staking services, and even some DeFi platforms. This means:- Any Australian company offering crypto services must now prove it can trace every transaction.

- Privacy coins will be impossible to integrate without breaking the rules.

- Even if a new exchange tries to list them, it won’t get licensed.

How Other Countries Compare

Australia’s approach is middle-of-the-road. Japan banned privacy coins outright in 2018. Dubai has a total ban. South Korea removed them from all top five exchanges in early 2025. On the other side, Switzerland and Liechtenstein still allow privacy coins - but only if exchanges implement strict KYC and transaction monitoring. Some Swiss platforms require users to voluntarily disclose transaction details to comply. It’s a compromise: privacy, but not anonymity. Australia chose the middle path: no outright ban, but no legal trading either. The result? A gray zone where ownership is legal, but access is blocked.

Why This Matters Beyond Privacy

Some users feel this is an attack on financial privacy. Others see it as necessary to stop crime. The truth is, both sides have a point. Privacy coins are used by journalists, activists, and people in oppressive regimes to protect their finances. But they’re also used by ransomware gangs, darknet markets, and tax evaders. Law enforcement admits they can’t trace Monero transactions - which is why the US IRS offered $625,000 to anyone who can break its encryption. The real question isn’t whether privacy is good or bad. It’s whether a financial system can function if half its transactions are invisible. Regulators say no. Privacy advocates say yes - if the system adapts.What’s Next for Privacy Coins in Australia

The market has already reacted. Trading volume for privacy coins in Australia has dropped by over 90% since early 2025. Liquidity has vanished. Prices are now driven by offshore demand and P2P speculation. Some developers are trying to build “compliant privacy coins” - versions that hide transaction details but allow regulators to unlock them with a legal warrant. But that defeats the purpose. If a government can peek behind the curtain, it’s not privacy anymore. For now, the only real option for Australians who want privacy coins is to use offshore exchanges - but that comes with risks: no consumer protection, no Australian dispute system, and potential tax complications if you don’t report holdings.What You Should Do Now

If you own privacy coins:- Keep them in a personal wallet - not on an exchange.

- Document how you acquired them. Tax authorities may ask.

- Don’t try to cash out through an Australian platform - it won’t work.

- If you need to sell, use a P2P platform - but verify the buyer and use escrow.

- Don’t rely on Australian exchanges - they won’t help.

- Consider whether the risks of P2P or offshore trading are worth it.

- Understand that you’re stepping outside the legal safety net.

Can I still own Monero or Zcash in Australia?

Yes. Australian law does not ban owning privacy coins. You can hold Monero, Zcash, Dash, or any other privacy coin in your personal wallet without breaking any rules. The ban only applies to trading them through licensed Australian exchanges.

Why can’t I trade privacy coins on Swyftx or CoinSpot?

Because AUSTRAC requires exchanges to track every transaction for anti-money laundering purposes. Privacy coins hide sender, receiver, and amount - making compliance impossible. Exchanges removed them to avoid losing their license, not because the government ordered it.

Is it legal to buy privacy coins on Binance or Kraken from Australia?

Technically yes - but it’s risky. Binance and Kraken are not licensed in Australia, so you have no consumer protection. If the platform freezes your funds or shuts down, you can’t take legal action in Australia. You also risk tax issues if you don’t report the purchase.

Will privacy coins come back to Australian exchanges after March 2026?

Almost certainly not. From March 31, 2026, AUSTRAC will require all digital asset service providers to meet the same AML/CTF standards. Privacy coins can’t meet those standards without losing their core features. Unless a new technology emerges that satisfies both privacy and traceability, they won’t return.

What happens if I don’t report my privacy coin holdings to the ATO?

You risk penalties. The ATO treats privacy coins like any other crypto asset. If you sell, trade, or convert them, you owe capital gains tax. The ATO has access to blockchain data from major exchanges and can cross-reference wallet addresses. Even if you bought them offshore, you’re still required to report them.

Are there any Australian exchanges still listing privacy coins?

No. As of November 2025, every licensed Australian crypto exchange has removed Monero, Zcash, Dash, and other privacy coins from their platforms. Any platform claiming to offer them is either unlicensed or misleading customers.

Arthur Coddington

November 12, 2025 AT 14:46This whole thing is just state control dressed up as financial safety. They don’t care about crime-they care about control. If you can’t track it, it doesn’t exist in their world. Welcome to the surveillance economy.

Monero isn’t evil. It’s just honest about privacy. The system’s the problem, not the coin.

Phil Bradley

November 14, 2025 AT 05:41Look, I get why regulators are scared. But banning privacy coins is like banning encrypted messaging because criminals use it. We’re trading freedom for the illusion of safety. And honestly? It’s pathetic.

Next they’ll ban cash because you can’t trace it. Where does it end?

Stephanie Platis

November 15, 2025 AT 23:55Actually, the regulation isn’t arbitrary-it’s legally mandated under the AML/CTF Act. The term ‘ban’ is misleading. Exchanges aren’t outlawing privacy coins; they’re complying with federal law. There’s a difference.

Also, ‘privacy’ doesn’t mean ‘untraceable.’ If you’re using Monero for legitimate purposes, you can still hold it. You just can’t launder money through it. And that’s not a bug-it’s a feature of democracy.

Michelle Elizabeth

November 17, 2025 AT 14:44It’s funny how people scream about ‘financial freedom’ while ignoring that real freedom requires accountability. You want privacy? Fine. But if you’re part of a financial ecosystem, you play by the rules.

Privacy coins are the crypto equivalent of wearing a ski mask to the bank. No one’s stopping you from wearing it-but no bank’s gonna let you in either.

Joy Whitenburg

November 17, 2025 AT 21:17lol i just bought some xmr on localmonero last week... paid 12% more but hey, at least i know my transaction isn’t being logged by some guy in a suit in canberra.

also, the australian tax office is gonna find you anyway. just fyi.

Kylie Stavinoha

November 19, 2025 AT 02:24There’s a philosophical tension here that transcends policy: Can a society function if its economic transactions are fundamentally opaque? Or must transparency be the bedrock of trust?

Privacy coins challenge the very architecture of modern finance. They aren’t just tools-they’re ideological statements. And like all ideologies, they collide with institutions built on visibility.

Switzerland’s compromise-voluntary disclosure-is the only path forward that doesn’t require surrendering principle or power.

But will Australia ever be brave enough to try it?

Diana Dodu

November 19, 2025 AT 18:04USA doesn’t do this. Why? Because we don’t let bureaucrats dictate what we can own. Australia’s becoming a financial police state. And now they want to extend this to wallets and DeFi? That’s not regulation-that’s tyranny.

Mark my words: this will backfire. People will move to unregulated platforms, and then the criminals will have even more freedom. Brilliant strategy, idiots.

Raymond Day

November 21, 2025 AT 14:40Let’s be real-this isn’t about crime. It’s about control. The IRS offered $625K to crack Monero? That’s a confession. They’re scared. They can’t track it, so they ban it.

Meanwhile, the same people who banned privacy coins are still using Venmo to send $500 to their cousin for ‘dinner.’

Pathetic. 😒

Also, if you’re holding crypto in a wallet, you’re fine. But if you try to cash out? They’ll come for you. Trust me. I’ve seen it happen.

Noriko Yashiro

November 22, 2025 AT 16:43As someone who’s lived in both the UK and Australia, I can say this: Australia’s approach is actually quite reasonable. Not perfect, but pragmatic.

People forget that exchanges aren’t just tech platforms-they’re financial institutions. And financial institutions can’t operate in the dark.

Yes, it’s inconvenient. But so is living in a society where anyone can hide their money from the taxman. I’d rather pay a little more in fees than fund a darknet market.

Atheeth Akash

November 23, 2025 AT 02:55Truth is, privacy coins are not for everyone. I hold them for personal reasons, but I don't expect the system to change for me.

Just keep them safe, report taxes, and don't stress. Life goes on.

James Ragin

November 25, 2025 AT 00:53They’re not banning privacy coins because of crime. They’re banning them because they’re preparing for digital currency control. The central bank digital currency (CBDC) is coming-and privacy coins are the last obstacle.

Once they eliminate all decentralized privacy, they can track every dollar you spend. Every coffee. Every book. Every protest donation.

This isn’t about AML. It’s about total financial surveillance. And March 2026 is just the beginning.

Wake up.

Michael Brooks

November 26, 2025 AT 22:34Here’s the real takeaway: if you want privacy coins, use a personal wallet. Don’t touch an exchange. Simple.

And if you’re worried about taxes? Keep records. The ATO doesn’t care if you hold Monero-they care if you sell it and don’t report the gain.

Also, P2P is risky but doable. Use escrow. Verify the buyer. Don’t be lazy.

It’s not that hard. You just have to take responsibility.

And yes, this ban will stick. The tech doesn’t exist yet to satisfy both regulators and privacy advocates. So stop hoping for magic.

David Billesbach

November 27, 2025 AT 03:01They’re lying to you. They say ‘you can still own them’-but what’s the point if you can’t trade them? You can own a gold bar too, but if every bank refuses to buy or sell it, you’re just holding a heavy rock.

This isn’t regulation-it’s economic strangulation. And they know it. That’s why they’re expanding to wallet providers next. They want to own your keys.

Monero isn’t the enemy. The people who wrote this law are.

They’re terrified of decentralized finance because it can’t be controlled. And they’d rather destroy it than adapt.

Andy Purvis

November 28, 2025 AT 07:34I think both sides have valid points. Regulators want to stop crime. Privacy advocates want to protect rights.

Maybe the answer isn’t banning-maybe it’s building better tools. Like regulated privacy protocols that allow warrants but still hide details from the public.

It’s possible. We just need to stop treating this like a war and start treating it like a design problem.

FRANCIS JOHNSON

November 29, 2025 AT 16:33History will judge this moment. Not as a regulatory win-but as a moral failure.

We built the internet to empower the individual. We built crypto to escape centralized control. And now we’re surrendering that dream because it’s inconvenient?

Monero isn’t just a coin. It’s a symbol of autonomy. And when we silence symbols, we silence ideas.

March 2026 isn’t just a date-it’s a turning point. Will we choose control… or courage?

🙏