Restaking Yield Calculator

Compare Your Restaking Strategy

Calculate potential returns and risk exposure based on your staking approach.

Risk Assessment

Slashing Risk 0.8-1.5% per year

Based on industry data: Correlated slashing events can cause significant losses during protocol failures.

Standard Staking

Restaking

Key Differences

Liquid Restaking

Simple setup, DeFi-compatible tokens, lower risk

Native Restaking

Higher rewards but complex setup, continuous monitoring required

Restaking isn’t just another yield farm. It’s a fundamental shift in how blockchain security works - letting one set of staked ETH do double (or triple) duty across multiple networks. If you’ve ever wondered why some protocols can launch with strong security without raising millions in funding, restaking is the answer. It takes the $63.7 billion already locked in Ethereum staking and turns it into a shared security pool for everything from oracles to bridges to rollups. No new validators. No new tokens. Just smarter reuse of existing capital.

How Restaking Actually Works

Restaking isn’t magic. It’s smart contract math. When you stake ETH on Ethereum, you’re helping secure the main chain by validating blocks. With restaking, you agree to let that same staked ETH also validate data or transactions on other protocols. Think of it like renting out your home security system to your neighbor’s house - you’re still paying for it, but now it protects two places at once. There are two ways to do it: native and liquid. Native restaking is for advanced users who run their own Ethereum validator nodes. These users download extra software - like EigenLayer’s middleware - and agree to additional slashing rules. If they mess up on Ethereum, they lose ETH. If they mess up on a restaked service like a data availability layer, they lose more. It’s high reward, high risk. Only about 38% of restakers go this route because it takes 15-20 hours to set up and demands constant monitoring across multiple dashboards. Liquid restaking is for everyone else. You deposit ETH into a platform like Renzo or Ether.fi, and they give you an LRT (liquid restaking token) in return. This token represents your staked ETH plus the extra security you’re providing to other chains. You can trade it, use it in DeFi, or hold it. The platform handles all the node management. Around 62% of users choose this path because it’s as simple as clicking a button.Why Restaking Matters: Solving the Security Bootstrapping Problem

Before restaking, new blockchain protocols had to build their own validator networks from scratch. That meant raising millions in capital, recruiting node operators, and hoping no one attacked them. It was expensive, slow, and risky. Restaking changes that. Now, a new oracle network like Chainlink’s CCIP or a data availability layer like Celestia can tap into Ethereum’s existing security. They don’t need their own stakers. They just need to convince validators to restake on them. Ethereum’s $63.7 billion in staked ETH becomes a trust anchor for dozens of smaller chains. This isn’t theoretical. In May 2024, Chainlink integrated restaking to secure its cross-chain messaging protocol. In August 2024, Celestia did the same. Both now benefit from the same economic security that protects Ethereum - without having to pay for it themselves.Where Restaking Is Being Used Right Now

Restaking isn’t just a buzzword. It’s already powering real infrastructure:- Decentralized oracles - Services like Chainlink and Chainlink CCIP use restaking to verify off-chain data without needing their own validator set.

- Data availability layers - Protocols like Celestia and Avail rely on restaking to ensure block data is published and available, preventing censorship.

- Blockchain bridges - Cross-chain bridges like LayerZero and Synapse are adopting restaking to prevent hacks. A bridge that’s secured by Ethereum’s validators is much harder to exploit.

- ZK-rollups and L2s - Many Layer 2 networks are exploring restaking to reduce reliance on centralized sequencers and improve decentralization.

- Permissionless middleware - New services like shared sequencers (for L2s) and decentralized storage networks are using restaking to bootstrap trust fast.

According to Delphi Digital, restaking is already securing 38% of new Ethereum-based protocols launched since January 2024. That number is expected to hit 70% by 2027.

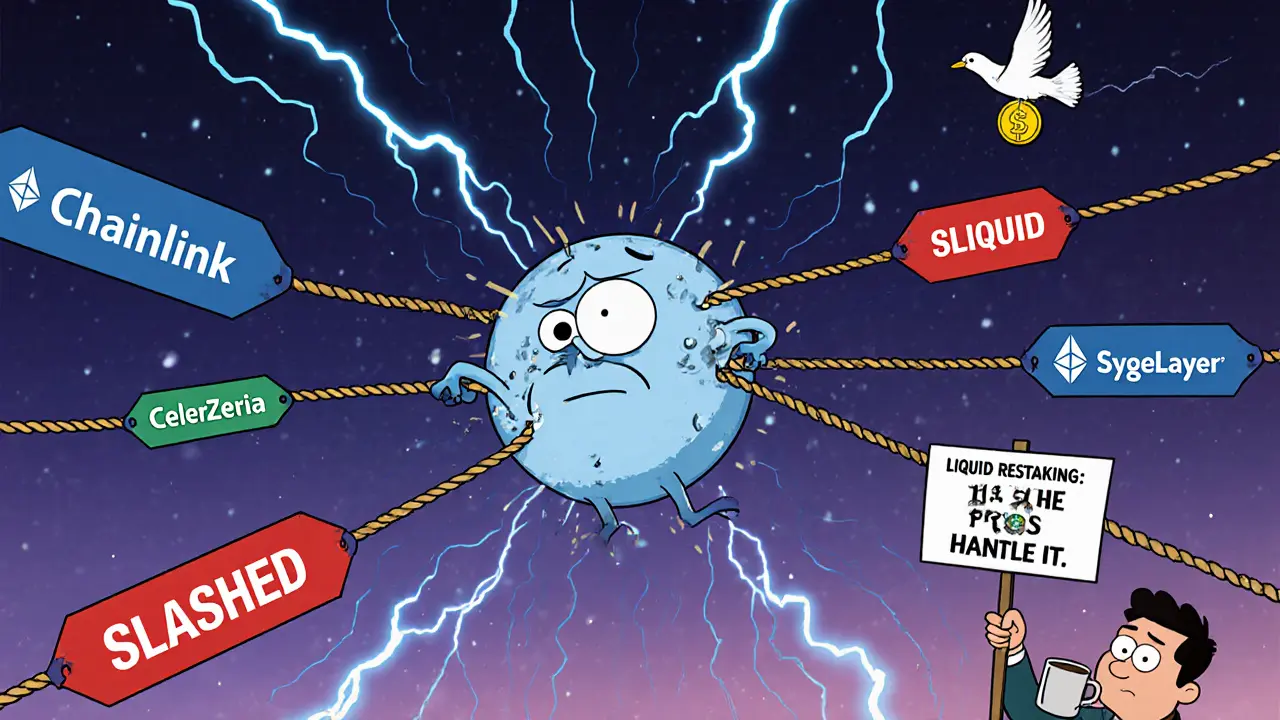

Yield vs. Risk: The Real Trade-Off

The big sell of restaking is higher returns. Standard Ethereum staking gives you 3-5% APY. Restaking can push that to 8-12% by adding rewards from the protocols you’re securing. But here’s the catch: you’re taking on more risk. Standard staking has one slashing condition: if you go offline or sign conflicting blocks on Ethereum, you lose a small portion of your ETH. Restaking adds 3-5 more slashing conditions per protocol you’re securing. If you mess up on EigenLayer, Renzo, and a data availability layer all at once? You could lose 2-3% of your stake in one go. In July 2024, a validator lost 0.87 ETH because it was slashed across three protocols simultaneously. That’s 1.74 ETH total penalties - more than most people earn in a year from staking. The biggest fear? Correlated slashing. If a bug, outage, or attack affects multiple protocols at once, dozens of validators could get slashed together. Security researcher Barnabé Monnot warned this could impact 5-7 protocols at once under stress. Gartner estimates a worst-case scenario could threaten 15-20% of all staked ETH.Who’s Leading the Market?

The restaking market is dominated by one player: EigenLayer. As of October 2024, it controls 72% of the total value locked - over $5.9 billion. It’s the original, the most audited, and the most widely adopted. Liquid restaking platforms are catching up:- Renzo - 14% market share. Known for easy integration and strong DeFi compatibility.

- Ether.fi - 9% market share. Popular for its user-friendly interface and 4.3/5 Trustpilot rating.

- Karak and Symbiotic - Smaller players focused on native restaking for advanced users.

Big exchanges like Kraken and Coinbase now offer restaking directly. You don’t need to manage a node - just click “restake” in your wallet.

What’s Next for Restaking?

Restaking is evolving fast. EigenLayer’s next update, scheduled for Q1 2025, will introduce “Actively Validated Services” - a new system that scores validators based on performance across protocols. The goal? Reduce the chance that one mistake takes down multiple services. Even Bitcoin is getting in on the act. Babylon announced a “Bitcoin staking” mechanism in October 2024, letting BTC holders lock coins to secure PoS chains. It’s not staking yet - no rewards - but it’s a step toward extending Ethereum-style security to other blockchains. The long-term vision? A modular security layer. Instead of every blockchain building its own security, they plug into a shared pool. Ethereum becomes the backbone. Other chains become consumers of security.Should You Restake?

If you’re a casual holder: go with liquid restaking. Pick Ether.fi or Renzo. It’s simple, safe enough, and gives you a solid yield bump. If you run a validator node: native restaking could boost your income significantly - but only if you’re ready to monitor multiple dashboards, understand complex slashing rules, and accept the risk of losing more than you earn. If you’re risk-averse: wait. The systemic risk hasn’t been tested in a full market crash. A 2024 Delphi Digital report gave restaking a 9.2/10 for innovation but a 7.8/10 for risk. That gap is real. Most importantly: don’t restake more than you’re comfortable losing. You’re not just staking ETH. You’re staking your trust in a new, unproven layer of the blockchain stack.What is restaking in blockchain?

Restaking lets you use the same staked ETH to secure multiple blockchain protocols at once. Instead of your ETH only helping secure Ethereum, it also helps secure services like oracles, bridges, and data layers - earning you extra rewards in the process.

Is restaking safe?

Restaking offers higher yields than regular staking, but it comes with more risk. You’re exposed to slashing penalties from multiple protocols, not just Ethereum. If a bug or attack affects several services at once, you could lose more ETH than you’d lose from standard staking. It’s not unsafe - but it’s not low-risk either.

What’s the difference between liquid and native restaking?

Native restaking requires you to run your own Ethereum validator node and manually add extra software to restake. It’s more complex but can offer higher returns. Liquid restaking lets you use platforms like Renzo or Ether.fi to restake with a single click. You get a liquid token (LRT) and can still use your assets in DeFi. It’s easier but slightly less profitable.

Which restaking protocol is the best?

EigenLayer is the leader with 72% market share and the most robust security model. For beginners, Renzo and Ether.fi are the best liquid options - they’re easy to use and have strong track records. If you’re a technical validator, EigenLayer or Karak offer the most control.

Can I lose money with restaking?

Yes. If your validator goes offline, misbehaves, or gets slashed on any of the protocols you’re securing, you can lose ETH. In one documented case, a validator lost 1.74 ETH after being slashed across three protocols simultaneously. Always understand the slashing rules before you restake.

Is restaking taxable?

Yes. In most jurisdictions, restaking rewards are treated as income when you receive them. This includes both Ethereum staking rewards and the extra yield from restaking. Tax software like Koinly and CoinTracker now support restaking tracking, but it’s still complex - many users report issues with multi-protocol reward reporting.

Will restaking work on other blockchains besides Ethereum?

Ethereum is the only chain with enough staked value to make restaking viable today. But projects like Babylon are exploring Bitcoin restaking, and Solana and Polygon are watching closely. If other chains reach similar staking levels, restaking could spread - but right now, it’s an Ethereum-native innovation.

dhirendra pratap singh

November 11, 2025 AT 07:54Ashley Mona

November 13, 2025 AT 00:19Edward Phuakwatana

November 13, 2025 AT 02:32Suhail Kashmiri

November 13, 2025 AT 16:07Kristin LeGard

November 13, 2025 AT 18:11Ruby Gilmartin

November 14, 2025 AT 01:42Douglas Tofoli

November 16, 2025 AT 00:19William Moylan

November 16, 2025 AT 12:10Michael Faggard

November 16, 2025 AT 17:22Wayne Dave Arceo

November 17, 2025 AT 17:15Joanne Lee

November 18, 2025 AT 23:41Michael Heitzer

November 20, 2025 AT 20:57Rebecca Saffle

November 22, 2025 AT 03:26Adrian Bailey

November 23, 2025 AT 10:37Johanna Lesmayoux lamare

November 23, 2025 AT 14:04ty ty

November 25, 2025 AT 13:30BRYAN CHAGUA

November 27, 2025 AT 07:48Debraj Dutta

November 27, 2025 AT 13:27