Crypto Return Calculator

Realistic vs. Scam Promises

This calculator compares realistic investment returns with the impossible promises made by exit scams like Satowallet. As highlighted in the article, any promise over 5% monthly return is a red flag.

Realistic Returns

Scam Promises (Satowallet Example)

Results

Realistic Investment Growth

After 12 months: $179.59

5% monthly returns are still very high for crypto. Realistic long-term returns for established platforms are typically 1-3% annually.

Scam Investment Growth (Satowallet Example)

After 12 months: $1,215,766.54

40% monthly returns are mathematically impossible to sustain. This is how exit scams like Satowallet lured users with impossible promises before disappearing.

Back in 2017, Satowallet promised African crypto users a simple, fee-free way to store, trade, and earn from their digital assets. It claimed to support over 60 cryptocurrencies, offered staking, airdrops, and even a 40% dividend on its own SATOS token. For a while, it looked like the perfect solution for people in Nigeria and other parts of Africa who were struggling with traditional banking restrictions. But by September 2019, the website was gone. The app stopped working. And thousands of users lost access to their funds - an estimated $1 million worth of crypto vanished overnight.

What Satowallet Actually Was

Satowallet wasn’t just another crypto wallet. It was a centralized exchange wrapped in the language of innovation. Founded in May 2017 by Samuel Benedict, it claimed to be based in Dubai but operated out of Abuja, Nigeria. That mismatch alone should’ve raised red flags. Most legitimate crypto platforms don’t hide their legal home. Satowallet did.The platform was available on Android, iOS, and web browsers. It promised no transaction fees - a huge draw in a market where fees eat into small profits. It also claimed to be open-source, which sounds transparent, but no one ever verified the code. No public GitHub repo. No audit reports. Just marketing claims.

Its biggest lure? The SATOS token. Users were told if they held SATOS, they’d get 40% dividends every month. That’s not how crypto works. No legitimate exchange pays out 40% monthly returns. That’s a classic Ponzi signal. It’s not sustainable. It’s designed to attract new users so old ones can get paid - until there’s no one left to pay.

The Red Flags That Were Ignored

By April 2019, users started posting on Telegram and Reddit asking if Satowallet was real. Withdrawals weren’t processing. Some said they’d waited weeks. Others got automated replies blaming "technical issues." Then, in June 2019, Satowallet rolled out mandatory KYC - requiring users to submit ID documents to access their own money. Why? Because the platform was already leaking. They needed to lock users in while they moved funds out.Here’s the kicker: the CEO, Samuel Benedict, used his Twitter account (@thesamuelben) to tell users the problem was with OVH.com - a major cloud provider. He blamed the hosting company for losing data. But OVH didn’t even host Satowallet’s wallet keys. They hosted a website. The real money was sitting on servers controlled by Satowallet’s team. That excuse was nonsense.

Then, in September 2019, the website went dark. The app stopped logging in. The Twitter account vanished. The Telegram groups turned into mourning halls. Users who had deposited Bitcoin, Ethereum, Litecoin - all gone. No refund. No explanation. No recovery.

Why It Wasn’t Just a Technical Failure

Some people try to say Satowallet was just poorly run. That’s not true. This followed the textbook pattern of an exit scam.- **Phase 1: Attract users with unrealistic promises** - 40% monthly dividends, zero fees, 60+ coins.

- **Phase 2: Lock funds with KYC** - Once users submitted IDs, they couldn’t easily leave.

- **Phase 3: Delay withdrawals under fake excuses** - "Technical issues," "security upgrades," "server migration."

- **Phase 4: Disappear** - Website down, social media gone, CEO silent.

Finance Magnates, a respected financial news outlet, published a detailed report on September 25, 2019, calling it an "alleged exit scam." Cryptowisser confirmed the site was down and warned users not to trust it. That was the end.

There was no "hacking." No "bankruptcy." No "regulatory shutdown." Just a team that took money from users and ran. The fact that they had a CEO, a Twitter handle, and a fake "parent company" (Blockchain Tech Hub) only made it more convincing - and more dangerous.

How It Compared to Real Exchanges

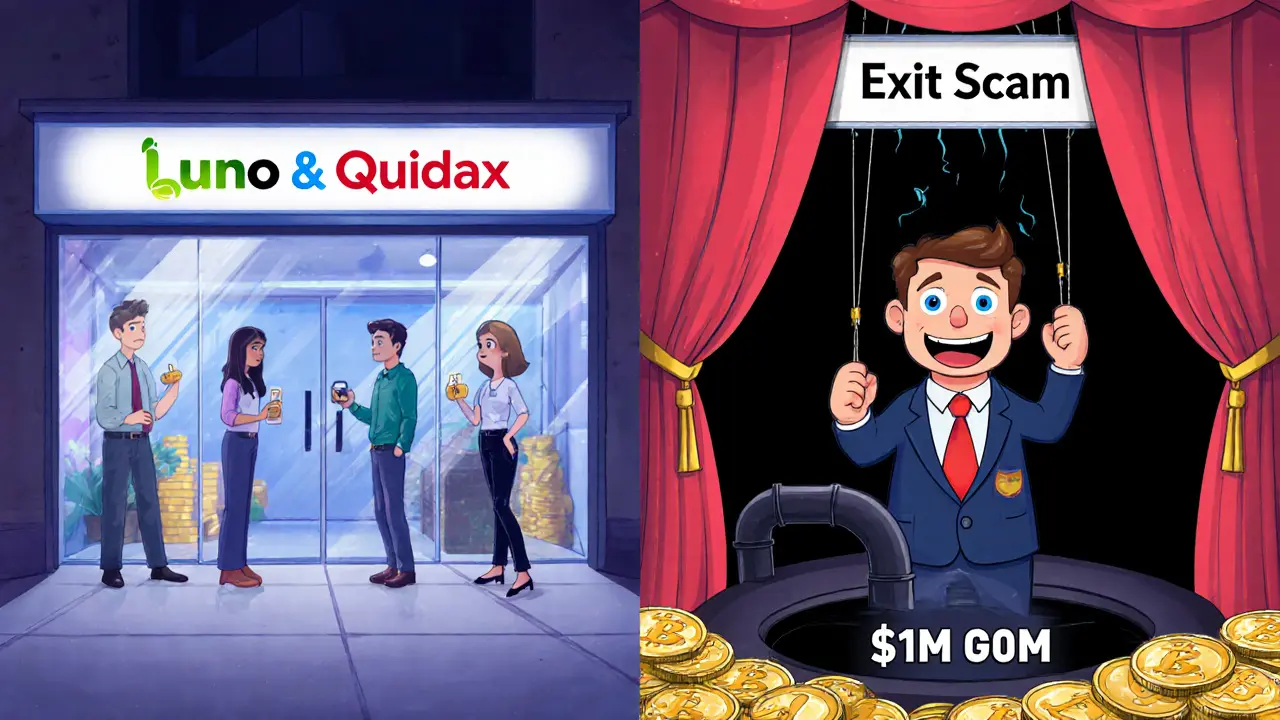

Satowallet wasn’t just bad - it was dangerously different from real platforms. Compare it to Luno or Quidax, both legitimate African exchanges that still operate today:| Feature | Satowallet | Luno / Quidax |

|---|---|---|

| Location Transparency | Claimed Dubai, operated from Nigeria | Clear legal registration in South Africa, Nigeria |

| Transaction Fees | Claimed zero - suspiciously unrealistic | Transparent, market-competitive fees |

| Dividend Program | 40% monthly on SATOS token | No such program - no fake internal tokens |

| KYC Process | Used to delay withdrawals | Used for compliance, not fund locking |

| Customer Support | Disappeared after September 2019 | 24/7 live support, email, phone |

| Current Status | Defunct since 2019 | Still operating as of 2025 |

Legitimate exchanges don’t promise impossible returns. They don’t hide their headquarters. They don’t shut down without warning. They follow regulations, even if imperfectly. Satowallet did none of that.

What Users Lost - And Why No One Got Their Money Back

Users weren’t just losing small amounts. The Finance Magnates report estimated over $1 million in crypto was stolen. That’s not a few hundred dollars. That’s life savings. Retirement funds. Money meant for school, rent, medical bills.Why couldn’t they get it back? Because the keys to those wallets were never in user control. Satowallet held everything. That’s the danger of centralized wallets. If the operator is honest, it’s convenient. If they’re a scammer, it’s a death sentence.

There was no blockchain recovery. No insurance. No legal recourse. Nigerian authorities didn’t pursue the case. The UAE didn’t recognize the company. No court ever issued a warrant. The money is gone. And the people who lost it? They’re still waiting.

Why This Matters Today

Satowallet didn’t just disappear. It left a mark. It taught a brutal lesson to African crypto users: if it sounds too good to be true, it is. Especially when it’s a new platform promising huge returns, no fees, and no paperwork - unless they ask for your ID first.Today, in 2025, new crypto scams still pop up. Fake staking platforms. Fake NFT marketplaces. Fake "crypto banks." They all use the same playbook: excitement, urgency, and fake trust. Satowallet was the blueprint.

Even now, some YouTube videos and Telegram groups still link to Satowallet’s old domain - hoping new users will fall for it. Don’t. The site is dead. The team is gone. And your crypto won’t come back.

How to Avoid a Satowallet-Style Scam

If you’re using a crypto exchange - especially in Africa or other emerging markets - follow these rules:- Check if it’s regulated. Look for registration with financial authorities like Nigeria’s SEC or South Africa’s FSCA.

- Never trust promises over 5% monthly. Anything higher is a red flag.

- Use only decentralized wallets for long-term storage. If you don’t control the private key, you don’t own the crypto.

- Research the team. Google the CEO’s name. Look for interviews, LinkedIn, past projects. If they’re invisible, walk away.

- Check community sentiment. Look at Reddit, Twitter, and Telegram. Are people complaining about withdrawals? Are there dozens of "I lost my money" posts?

- Start small. Test with $10 before depositing $1,000.

Satowallet didn’t fail because it was new. It failed because it was dishonest from day one.

Is Satowallet still operational in 2025?

No, Satowallet has been completely defunct since September 2019. The website is offline, the mobile apps no longer work, and all social media accounts have been deleted. There is no way to access your funds or create a new account. It is officially classified as a scam by multiple crypto watchdogs.

Did anyone recover their funds from Satowallet?

No, there are no verified reports of any user recovering their cryptocurrency after the platform shut down. The funds were transferred out by the operators before the site went offline, and there was no blockchain trace or legal action that led to recovery. The $1 million in losses remains unrecovered.

Was Satowallet a legitimate African crypto exchange?

No. While it targeted African users and claimed to be based in Dubai, it had no legal registration, no transparent ownership, and no compliance with any financial authority. It operated as a centralized wallet with no real security infrastructure, and its entire business model relied on taking user funds and disappearing - the definition of an exit scam.

What made Satowallet different from other crypto wallets?

Satowallet stood out only because of its unrealistic promises: zero fees, 40% monthly dividends on SATOS tokens, and no transaction limits. These were marketing traps, not features. Unlike real wallets like TrustWallet or Exodus, Satowallet held all private keys - meaning users had zero control over their assets. That’s the opposite of what a true crypto wallet should do.

Should I avoid all African crypto exchanges because of Satowallet?

No. Satowallet was a scam, not a reflection of African crypto exchanges. Platforms like Luno, Quidax, and Binance Africa are regulated, transparent, and still operating today. The difference is accountability. Always check if an exchange has public registration, clear leadership, and real customer support. Don’t judge by geography - judge by behavior.

Can I trust any crypto platform that offers high returns?

Never. No legitimate crypto exchange offers guaranteed returns above 1-2% annually. Anything higher - especially 10%, 20%, or 40% monthly - is a scam. Real returns come from market growth, not from a company promising you magic. If they’re paying you from new users’ deposits, it’s a Ponzi. Walk away.

Ashley Mona

November 10, 2025 AT 18:14Ugh, I remember when Satowallet was everywhere on Reddit. People were posting screenshots of their '40% monthly returns' like it was a lottery win. I tried to warn a few folks in the r/CryptoCurrencyAfrica thread, but they called me a FUDster 😅 Turns out, I was just the only one who read the fine print... or, well, the lack thereof. Never trust a platform that treats your crypto like a bank account with a magic money tree.

Edward Phuakwatana

November 11, 2025 AT 13:28Satowallet was the perfect storm of crypto delusion: zero fees? 40% monthly dividends? It wasn’t a platform-it was a behavioral economics experiment gone rogue. The CEO didn’t just lie-he weaponized hope. People weren’t investing in crypto, they were investing in the fantasy of financial liberation. And when the fantasy collapsed, they didn’t just lose money-they lost trust in the entire ecosystem. That’s the real cost of exit scams.

Suhail Kashmiri

November 13, 2025 AT 09:48Bro, this is why Africans keep getting scammed-too eager to get rich quick. No one in the West would fall for this nonsense. You think you’re being smart by skipping fees? Nah, you’re just handing your life savings to some guy in Abuja with a fake Dubai address. Learn the basics before you touch crypto. No excuses.

Kristin LeGard

November 13, 2025 AT 16:02Can we talk about how insane it is that people still think 'no fees' means 'no catch'? That’s like saying 'free air'-it doesn’t exist. Satowallet didn’t steal money. It stole *expectations*. People thought crypto was a shortcut to wealth, not a volatile, unregulated jungle. And now they’re mad when the jungle bites back. Wake up. Crypto doesn’t owe you anything.

Arthur Coddington

November 14, 2025 AT 04:32I just sit here and wonder-how many people lost their rent money? How many students lost their tuition? How many moms lost the money they saved for their kid’s surgery? And the CEO? Probably sipping a margarita in Bali with a new passport. This isn’t finance. This is theater. And we’re all just extras in a tragedy written by greed.

Phil Bradley

November 15, 2025 AT 23:57Man, I used to think Satowallet was legit until I saw the KYC trap. That’s when I knew-this wasn’t a platform, it was a trapdoor. You give them your ID, they lock you in, and then they vanish. It’s like dating someone who asks for your home address on the first date. Red flag? More like a whole damn fireworks show. I still shudder thinking about how many people got played.

Stephanie Platis

November 16, 2025 AT 16:57Let’s be clear: Satowallet wasn’t ‘poorly run.’ It was deliberately designed to fail. Every element-the fake Dubai address, the non-existent GitHub, the 40% dividends, the mandatory KYC-was engineered to extract value and disappear. This wasn’t incompetence. It was criminal architecture. And the fact that no one was prosecuted? That’s the real scandal.

Michelle Elizabeth

November 17, 2025 AT 09:04It’s funny how people romanticize these scams. Like, ‘Oh, it’s just crypto being crypto.’ No. This was a calculated theft dressed up as innovation. The SATOS token? A glorified IOU with no backing. The ‘zero fees’? A bait-and-switch. And the users? Just numbers in a spreadsheet. I feel sick thinking about it.

Joy Whitenburg

November 19, 2025 AT 05:11ok but like… i just wanna say thank you for writing this. i lost my savings to something like this in 2018, and i never talked about it. reading this made me feel less alone. you’re not just sharing info-you’re giving people permission to grieve. 💔

Kylie Stavinoha

November 20, 2025 AT 07:49What Satowallet exposed wasn’t just a flawed business model-it was a cultural vulnerability. In regions where formal banking systems are inaccessible, crypto becomes a symbol of autonomy. But when that symbol is hijacked by fraudsters, it doesn’t just steal money-it steals dignity. The real tragedy isn’t the $1 million lost. It’s the erosion of trust in tools meant to empower the marginalized.

Diana Dodu

November 20, 2025 AT 21:11USA doesn’t get it. This isn’t some abstract crypto drama. This is people in Lagos losing their life savings because some guy in a basement lied to them. And now we’re all stuck cleaning up the mess because the West thinks ‘Africa’ is just a crypto meme. Wake up. This is a humanitarian issue disguised as a financial one.