Digital Currency Success Calculator

How to Use This Calculator

Estimate the success of a country's digital currency implementation based on key factors. Each factor has a score between 0-100, with 100 being optimal.

When you think of money, you probably picture cash in your wallet or a bank transfer on your phone. But around the world, that’s changing-fast. No country has fully scrapped physical cash yet, but 137 nations are now actively building or testing digital versions of their currencies. This isn’t science fiction. It’s happening right now, in real time, with real consequences for how people pay, save, and survive financially.

What’s Actually Happening? CBDCs Are the Main Story

The biggest shift isn’t about Bitcoin or Ethereum. It’s about Central Bank Digital Currencies, or CBDCs. These aren’t decentralized like Bitcoin. They’re digital versions of your country’s existing money-issued, controlled, and backed by the central bank. Think of them as electronic cash that the government can track, limit, or even program with rules.

The Bahamas got there first. In October 2020, they launched the Sand Dollar, the world’s first fully operational CBDC. It works on basic smartphones, even without internet, thanks to NFC chips. People in remote islands like Exuma can now pay for fish, medicine, or school fees without walking miles to a bank. By Q3 2025, 98.7% of Bahamians had access to it. That’s not just tech-it’s financial inclusion.

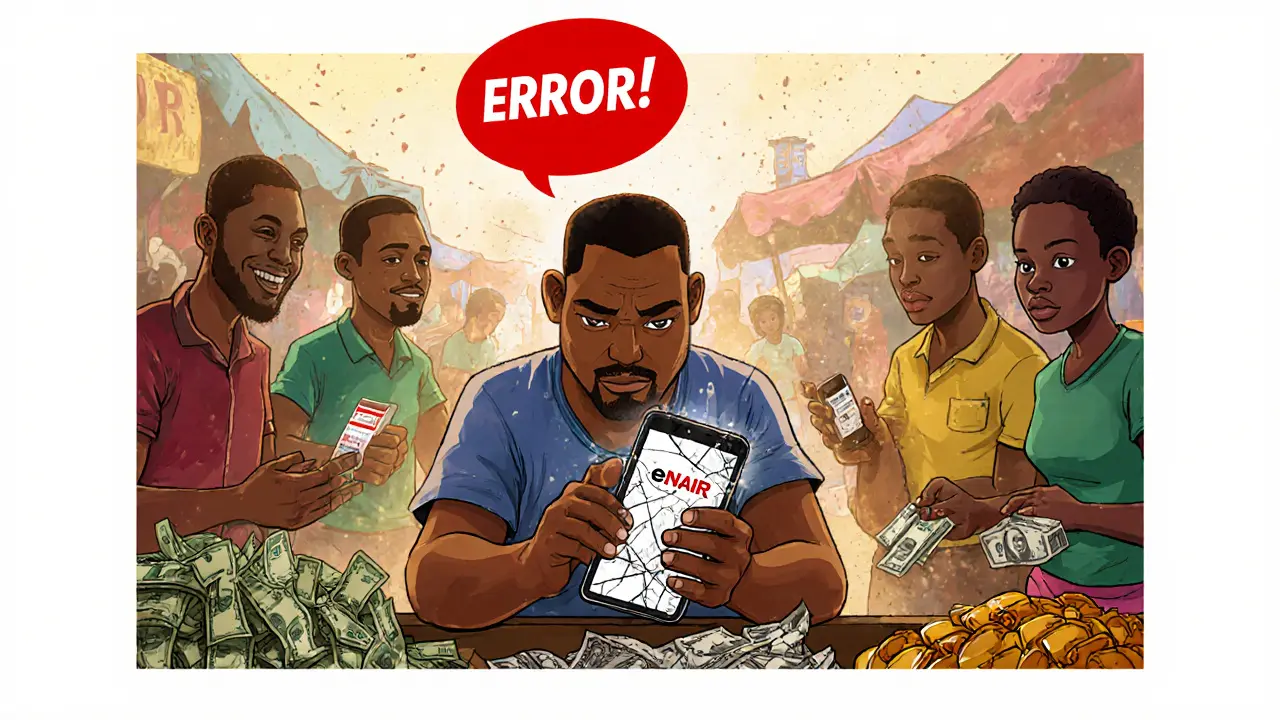

Nigeria followed in 2021 with the e-Naira. But here’s the twist: despite having higher smartphone use than the Bahamas, only 43.2% of Nigerians use it. Why? Poor app performance, few merchants accepting it, and confusing instructions. The World Bank called it a textbook case of tech rollout failing to match real-world needs.

China’s digital yuan is the biggest in scale. Over ¥1.8 trillion ($250 billion) has been transacted since 2022 across 26 pilot cities. But it’s still not nationwide. The government controls every transaction. Want to buy a car? The system can block it if you’re flagged. Want to pay for protest supplies? That’s a risk. This isn’t freedom-it’s control.

El Salvador: The One Country That Bet on Bitcoin

While most countries are building government-controlled digital money, El Salvador went the other way. In 2021, it made Bitcoin legal tender alongside the U.S. dollar. It was bold. It was risky. And it’s not working like they hoped.

Eighty-seven percent of transactions in El Salvador are still in U.S. dollars. Only 38% of citizens regularly use the Chivo wallet. People complain about Bitcoin’s wild swings-prices changing between when they order food and when the payment clears. One Reddit user from San Salvador said: “I paid for coffee with Bitcoin. By the time it confirmed, the price dropped 12%. I lost money just for buying coffee.”

The government bought over 5,000 BTC, spending $300 million. But Bitcoin’s volatility makes it terrible for daily spending. It’s better as a speculative asset than as money. The IMF pressured El Salvador to roll back the law. The country didn’t fully abandon it, but the momentum died.

How Do These Systems Actually Work?

Not all digital currencies are built the same. Here’s how three key ones stack up:

| Country | Currency | Type | Transaction Speed | Offline Support | Population Coverage (Q3 2025) |

|---|---|---|---|---|---|

| Bahamas | Sand Dollar | CBDC | 1.2 seconds | Yes (NFC) | 98.7% |

| Nigeria | e-Naira | CBDC | 3.5 seconds | No | 43.2% |

| Jamaica | JAM-DEX | Hybrid CBDC | 2.5 seconds | Partial | 71% |

| El Salvador | Bitcoin | Cryptocurrency | 10 minutes | No | 38% |

The Sand Dollar wins on simplicity. You don’t need to understand blockchain. You just tap your phone. Jamaica’s JAM-DEX integrates with existing mobile money apps like Digicel Pay, so users don’t have to learn a whole new system. Nigeria’s app? It crashes. People uninstall it.

China’s digital yuan supports offline hardware wallets-tiny devices that store the currency like a USB stick. You can pay at a market stall even if the internet is down. That’s smart design. But it’s also surveillance. Every transaction is logged by the state.

Who’s Winning? Who’s Struggling?

Success isn’t about tech specs. It’s about trust, ease, and usefulness.

In the Bahamas, 94% of users are satisfied. Why? Because the Sand Dollar solved a real problem: access. If you live on a small island, the bank is 30 miles away. The Sand Dollar puts money in your pocket-digitally.

In Jamaica, 89% of users like the “Send Money” feature. It works with their existing phone numbers. No app download needed. Just text a code. That’s how you get adoption.

Nigeria? 68% of users say the e-Naira is unreliable. Merchants don’t accept it. The app freezes. People give up. The government didn’t build for the user-they built for the system.

And then there’s the Eastern Caribbean’s DCash. It uses quantum-resistant encryption-future-proof tech. But street vendors reject it because the POS devices cost $80. Most can’t afford it. Tech means nothing if people can’t afford to use it.

The Bigger Picture: Why This Matters

Some experts say CBDCs are just an upgrade to the banking system. Dr. Darrell Duffie from Stanford calls it “evolution, not revolution.” He’s right. Most CBDCs don’t change how money works-they just make it digital.

But others, like Dr. Neha Narula from MIT, point out the real failure: financial inclusion. 76% of central banks say they want to help the unbanked. But only 22% have built features for them. If your CBDC needs a smartphone, internet, and a bank account, it’s not helping the poor-it’s leaving them behind.

There’s also a hidden danger: bank runs. If people panic during a crisis, they could pull all their money out of banks and into CBDCs. Dr. Eswar Prasad from Cornell warns this could collapse commercial banks. In simulations, deposit flight could hit 25% in a single week.

Meanwhile, private stablecoins like USDC and USDT are creeping into CBDC systems. The U.S. Federal Reserve is testing integration with them. That’s a quiet revolution. It means the future of money might not be government-only-but a mix of public and private digital money.

What’s Next? The Road to 2030

The Bank for International Settlements predicts 90% of central banks will have launched CBDCs by 2030. India’s Digital Rupee is now at 10 million users. The European Central Bank is testing its digital euro with 30,000 people. Switzerland and France are working on cross-border CBDC payments.

But here’s the truth no one wants to say: cash isn’t disappearing. Not yet. Not ever, probably. Even in China, cash is still used in rural areas. In El Salvador, people still pay in dollars. In Nigeria, many still use mobile airtime credits to send money.

The future isn’t one system replacing another. It’s layers. Cash for the elderly. CBDCs for daily payments. Stablecoins for international transfers. Bitcoin for speculation or resistance. All coexisting.

What’s clear is this: money is no longer just paper or digits in a bank. It’s code. And who controls the code, controls the economy.

Has any country completely replaced fiat currency with digital money?

No country has fully replaced physical cash with digital currency. Even in the Bahamas, where the Sand Dollar is widely used, cash is still available and accepted. All CBDCs are designed to coexist with physical money, not eliminate it. Governments fear alienating older populations, rural communities, and people without smartphones. Cash remains a fallback for emergencies, privacy, and inclusion.

Why is Nigeria’s e-Naira failing despite high smartphone use?

Nigeria’s e-Naira struggles because it’s poorly designed for users. The app crashes frequently, merchants rarely accept it, and the government didn’t invest in education or incentives. People don’t see a reason to switch from mobile money apps like Opay or Paga, which work better. High smartphone use doesn’t guarantee digital adoption-usability does.

Can Bitcoin be used as everyday money like a CBDC?

Not really. Bitcoin’s transaction speed is too slow (10 minutes per confirmation) and fees spike during high demand. Its price swings make it unreliable for buying groceries or paying rent. El Salvador’s experiment proved that making Bitcoin legal tender doesn’t make it practical for daily use. CBDCs, with instant settlement and stable value, are far better suited for everyday transactions.

Are CBDCs safe from hacking?

Yes, most CBDCs are built with military-grade encryption. The Eastern Caribbean’s DCash uses quantum-resistant algorithms. China’s digital yuan uses a closed, permissioned system with no public access. But safety isn’t just about hacking-it’s about control. CBDCs can be frozen, restricted, or monitored by the government. That’s not a flaw-it’s by design.

Will CBDCs replace banks?

No-but they could weaken them. If people start holding digital currency directly with the central bank instead of in commercial banks, banks could lose deposits. That’s a problem because banks lend that money to businesses and homeowners. Central banks are aware of this risk and are designing CBDCs with limits: some cap holdings, others charge fees for large balances. The goal is to complement, not replace, the banking system.

What’s the difference between a CBDC and a cryptocurrency like Bitcoin?

A CBDC is issued and controlled by a central bank-it’s digital fiat. Bitcoin is decentralized, not owned by any government, and its supply is capped at 21 million. CBDCs can be tracked, restricted, or programmed. Bitcoin transactions are pseudonymous and irreversible. One is government money, the other is peer-to-peer money. They serve very different purposes.

Final Thought: Money Is Power

The shift from cash to digital isn’t just about technology. It’s about who holds the keys. Governments want control. Corporations want access. People want freedom. The countries that get this right-like the Bahamas-won’t just modernize payments. They’ll empower their citizens. The ones that don’t-like Nigeria-will end up with expensive, unused apps and frustrated people.

The future of money isn’t about replacing cash. It’s about giving people better tools. And that’s something every country, rich or poor, can still choose to do right.

Edward Phuakwatana

November 12, 2025 AT 02:07Let’s be real-this isn’t just about tech, it’s about sovereignty. CBDCs are the new frontier of state power, and the Bahamas got it right by prioritizing access over control. But China? They’re not building a currency, they’re building a surveillance grid with a payment interface. Bitcoin’s volatility makes it useless for groceries, but as a hedge against authoritarian monetary policy? Pure gold. We’re not just digitizing money-we’re digitizing freedom. And whoever controls the code controls the future. 🚀

Elizabeth Stavitzke

November 13, 2025 AT 09:06Oh please. You’re comparing a Caribbean island’s NFC-based cash substitute to China’s digital yuan and calling it ‘financial inclusion’? The Sand Dollar works because the population is 400,000 and everyone knows each other. Meanwhile, Nigeria’s failure is just proof that you can’t force modernity on people who still use WhatsApp to send money. Honestly, if you need a smartphone to pay for fish, you’re already not the target audience. Wake up.

Laura Hall

November 15, 2025 AT 07:06Y’all are overcomplicating this. The real win isn’t the tech-it’s the *why*. The Bahamas didn’t build a CBDC because they wanted to be ‘cutting edge.’ They built it because grandmas in Exuma walked 3 hours to cash checks. That’s it. No blockchain jargon. No crypto bros. Just a damn app that works on a $50 phone. Nigeria’s problem? They built a Ferrari and gave it to people who still need a bicycle. Stop romanticizing tech. Solve actual problems.

Wayne Dave Arceo

November 16, 2025 AT 12:44Correction: El Salvador didn’t ‘bet on Bitcoin’-they bet on political theater. Making Bitcoin legal tender was a PR stunt designed to attract venture capital and distract from corruption. The IMF was right to pressure them. Bitcoin is not money. It’s a speculative asset with the liquidity of a haunted house. And anyone who claims it’s ‘resistance’ is just a libertarian fantasy-ist with a Coinbase account. Real money has stability. CBDCs at least have that. The rest is noise.

Brian Gillespie

November 17, 2025 AT 19:19My uncle in rural Mississippi still uses cash. He doesn’t trust banks. Doesn’t own a phone. But he’s got a jar of coins under his bed. That’s not a flaw-it’s dignity. CBDCs aren’t the future unless they include people like him. Tech isn’t the barrier. Design is. And right now, most governments are designing for themselves, not the people.

Ashley Mona

November 18, 2025 AT 22:46Okay but imagine this: you’re in a flood zone, your bank’s offline, your phone’s dead-but you’ve got a tiny hardware wallet with 500 bucks of digital yuan stored on it. You tap it at the relief station, no internet needed. That’s not sci-fi. That’s China’s design. Yeah, it’s tracked. But if you’re drowning, do you care who knows you bought bottled water? Sometimes control isn’t oppression-it’s survival. 🌊💧

Kristin LeGard

November 20, 2025 AT 00:36Stop acting like Nigeria’s failure is a mystery. They built an app that crashes on Android 8 and expect poor people to use it? Meanwhile, India’s Digital Rupee is already at 10M users because they partnered with *existing* apps like Paytm. No one needs a new app. Just plug into what people already use. It’s not rocket science. It’s basic UX. But apparently, bureaucrats think ‘innovation’ means reinventing the wheel while ignoring the driver.

Ainsley Ross

November 21, 2025 AT 11:03It’s fascinating how Western discourse romanticizes the Bahamas’ success while dismissing China’s scale as ‘authoritarian.’ The Sand Dollar works because it’s small, homogenous, and low-risk. China’s digital yuan is a masterclass in infrastructure, scalability, and state coordination. It’s not about oppression-it’s about efficiency. When 1.4 billion people can transact in under two seconds, offline, with zero fees, calling it ‘surveillance’ misses the point. You want freedom? Then admit that sometimes, control enables inclusion.

Michael Brooks

November 22, 2025 AT 11:15Here’s what no one’s saying: the real winners aren’t the countries with the fanciest tech. They’re the ones who didn’t try to force a revolution. Jamaica’s JAM-DEX? Text a code. No app. No login. Works on any phone. That’s genius. The Bahamas? They didn’t ask people to ‘adopt digital currency.’ They just made it the easiest way to pay. No lectures. No propaganda. Just… better. That’s how you win. Not with blockchain whitepapers. With empathy.

Meanwhile, we’re still arguing about Bitcoin as money like it’s 2017. Wake up. The future isn’t decentralized. It’s interoperable. CBDCs + stablecoins + cash = layered resilience. The goal isn’t to replace cash. It’s to make sure no one’s left behind when the world moves on.

Also-stop calling Bitcoin ‘digital gold.’ It’s not. It’s a volatile, slow, energy-hungry gamble. If you want to store value, buy silver. If you want to pay for lunch, use your bank app. Let’s stop pretending crypto is the answer to everything.

Suhail Kashmiri

November 23, 2025 AT 09:46Bro, Nigeria’s e-Naira is trash because the government is corrupt as hell. Why would I use a digital currency that can be frozen by some bureaucrat who hates my tribe? I use Opay. It works. It’s fast. And I don’t have to trust the state. CBDCs are just digital colonialism with better UI.

Johanna Lesmayoux lamare

November 24, 2025 AT 13:15Just saw my neighbor use the Sand Dollar to pay for her insulin. No bank. No card. Just tapped her phone. She cried. Not because it’s tech. Because for the first time, she didn’t have to choose between medicine and bus fare. That’s what this is about. Not control. Not crypto. Just… dignity.

Joanne Lee

November 24, 2025 AT 16:18One critical point often overlooked: CBDCs are not inherently incompatible with privacy. The design choices-such as tiered anonymity, offline capabilities, and data minimization-are policy decisions, not technical inevitabilities. The Eastern Caribbean’s quantum-resistant encryption and Nigeria’s lack of offline support reflect political priorities, not technological limits. The question isn’t whether digital money can be private-it’s whether governments choose to make it so. And that’s where the real battle lies.

Laura Hall

November 26, 2025 AT 01:23Wait, so if the Bahamas made a CBDC that actually works, and Nigeria made one that’s a disaster… does that mean the problem isn’t digital money? It’s just bad government? 🤔