As of July 2025, Algerians cannot legally access cryptocurrency exchanges-not because of technical barriers, slow internet, or lack of interest, but because the government made it a crime. Law No. 25-10, published on July 24, 2025, outlawed every single activity related to digital assets: buying, selling, holding, mining, trading, even talking about them publicly as investment advice. It’s not a gray area. It’s a hard stop. If you’re in Algeria and you use a crypto exchange, you’re breaking the law.

What the Law Actually Bans

Law No. 25-10 doesn’t just target exchanges like Binance or Coinbase. It criminalizes anything connected to cryptocurrency. That includes:

- Buying or selling Bitcoin, Ethereum, or any other digital coin

- Storing crypto in a digital wallet-even if it’s on your phone

- Using decentralized exchanges (DEXs) like Uniswap or PancakeSwap

- Operating a platform that facilitates crypto trades

- Advertising or promoting crypto as a financial tool

- Teaching others how blockchain works if it’s tied to crypto use

The law defines cryptocurrencies as “virtual instruments used as means of exchange via a computer system, without support from a central bank.” That’s it. No gray language. No loopholes. No exceptions for personal use or small amounts. Even holding $50 worth of Bitcoin in a wallet is illegal.

Penalties Are Harsh-and Enforced

The penalties aren’t warnings or fines you can ignore. They’re jail time and heavy financial punishment. If caught, you could face:

- Two months to one year in prison

- Fines between 200,000 and 1,000,000 Algerian dinars ($1,540-$7,700)

- Fines up to 2,000,000 dinars ($14,700) for repeat offenses or organized activity

- Double penalties if linked to money laundering or criminal networks

These aren’t theoretical. Algerian authorities have ramped up digital surveillance. They monitor internet traffic, track VPN usage, and scan peer-to-peer messaging apps for crypto-related keywords. Local reports confirm that arrests have already occurred since the law took effect. People who used Telegram groups to coordinate P2P trades are being investigated. Those who ran local crypto meetups are being called in for questioning.

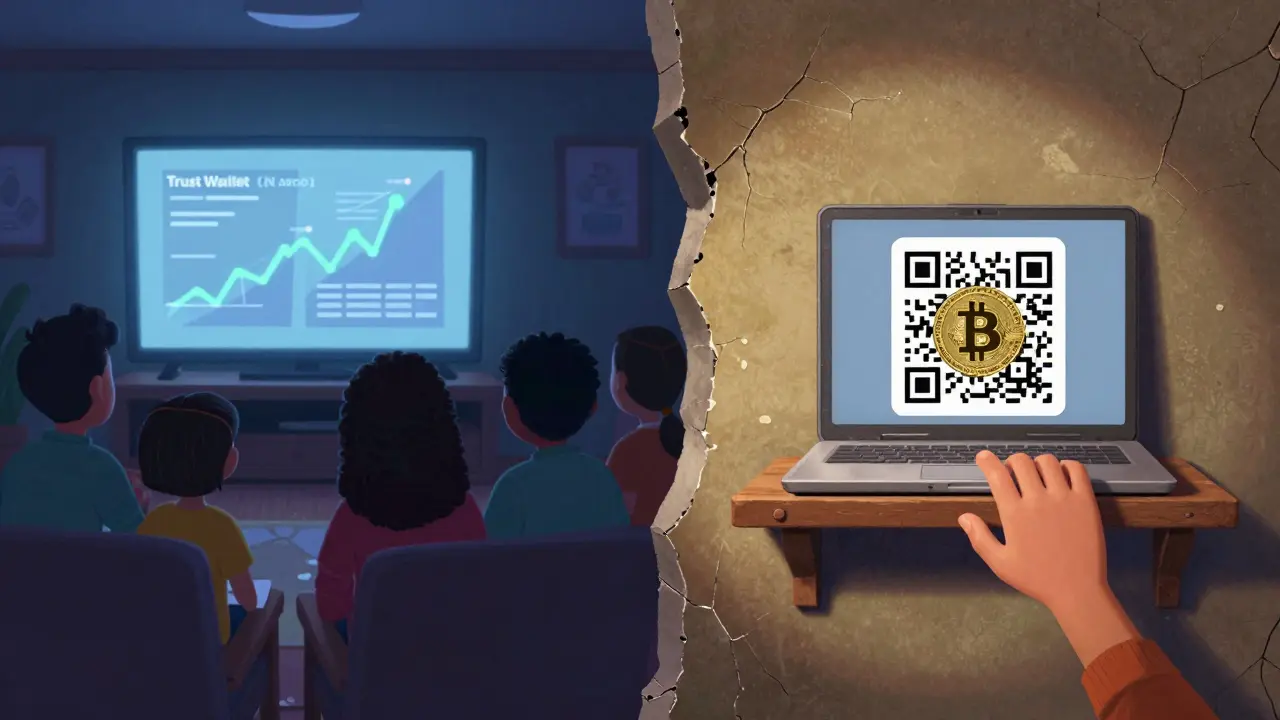

How People Are Still Trying to Access Crypto

Despite the ban, demand hasn’t disappeared. Many Algerians still want access to crypto-not for speculation, but for survival. With inflation eating away at the dinar and limited access to foreign currency, crypto offers a lifeline. So people find ways.

Some use VPNs to mask their IP addresses and sign up for international exchanges like Kraken or Bybit. Others trade directly with friends using WhatsApp or Signal, sending cash in person and receiving crypto via wallet transfers. A few use non-KYC decentralized wallets like Trust Wallet or MetaMask to store coins bought abroad. But every step carries risk.

There’s no safe way. Even if you don’t trade, just having a crypto wallet on your phone can trigger automated monitoring systems. Authorities don’t need proof of a transaction-they just need evidence of possession. A single screenshot of a wallet balance can be enough for a case to open.

What Changed in Just a Year

It wasn’t always this way. Just 12 months before the ban, Algeria was one of the fastest-growing crypto markets in North Africa. Chainalysis ranked it in the top five in the MENA region for peer-to-peer trading volume. Young professionals, freelancers, and even small business owners were using crypto to send money across borders, pay for online services, or protect savings from currency devaluation.

Then came the law. Overnight, crypto meetups vanished. Online courses disappeared from YouTube. Developers who built blockchain tools for local use either shut down or left the country. What was once a thriving underground ecosystem became a liability.

Why the Government Did This

The Algerian government says it’s protecting financial stability and preventing money laundering. They cite guidance from the Financial Action Task Force (FATF), which pushes countries to control anonymous financial flows. But the timing is telling. Algeria’s economy is struggling. The dinar is weak. Foreign reserves are shrinking. The state wants total control over capital movement.

Unlike countries like Nigeria or Kenya, where regulators are trying to bring crypto into the formal system, Algeria chose total suppression. There’s no licensing path. No sandbox. No pilot program. Just a wall.

Critics argue the ban backfires. By pushing crypto underground, it makes oversight harder. It drives talent away. It cuts Algerians off from global financial tools that millions elsewhere use daily. And it doesn’t stop demand-it just makes it more dangerous.

What This Means for the Future

Algeria is now one of only nine countries in the world with a total crypto ban. The others include China, Egypt, and a few others with strict controls. But Algeria’s law is uniquely broad-it doesn’t just ban trading. It bans knowledge. It bans discussion. It bans the very idea that digital money could be useful.

For now, there’s no legal path forward. No exchange will operate inside Algeria. No bank will offer crypto services. No regulator will issue licenses. The door is locked-and the key was thrown away.

Until the law changes, Algerians who want crypto access must choose between isolation and risk. And right now, the cost of access is higher than it’s ever been: freedom.

What About Blockchain Technology?

It’s important to note: the law doesn’t ban blockchain. It bans cryptocurrency. In theory, a developer could still build a blockchain-based land registry or supply chain tool, as long as it doesn’t involve tokens or digital currency. But in practice, the fear is so strong that most tech teams avoid anything even remotely connected to blockchain. The stigma is real. The risk is too high.

Some universities still teach blockchain theory in computer science classes-but only if they avoid mentioning Bitcoin or Ethereum. The line between education and violation is razor-thin.