SpaceGen - Page 8

Shadow Exchange v2 Crypto Exchange Review: Speed, Fees, and the Sonic Ecosystem Advantage

Shadow Exchange v2 is a high-speed, low-fee decentralized exchange built for the Sonic blockchain. With sub-second trades, 95% lower fees than Ethereum, and a unique x(3,3) reward model, it's ideal for active traders and yield farmers in the Sonic ecosystem.

- November 14 2025

- Terri DeLange

- 20 Comments

MultiPad (MPAD) CMC Airdrop: How to Participate and What You Need to Know in 2025

Learn how to qualify for the MultiPad (MPAD) CMC airdrop in 2025, what makes it different from past airdrops, and how to avoid scams. Get the real steps to win 20.25 MPAD tokens.

- November 14 2025

- Terri DeLange

- 12 Comments

How to Buy Crypto with Fiat in India: 2025 Step-by-Step Guide

Learn how to buy cryptocurrency with Indian rupees in 2025 using UPI, avoid tax traps, pick the best exchange, and stay secure. Step-by-step guide for beginners.

- November 12 2025

- Terri DeLange

- 18 Comments

What is FISH2 (FISH2) crypto coin? The SpaceX meme scam explained

FISH2 is a meme crypto coin built on a fake SpaceX mission story. With no real team, no audits, and zero market value, it's a high-risk scam targeting inexperienced investors. Avoid it.

- November 10 2025

- Terri DeLange

- 18 Comments

Future of Wrapped Asset Standards in Blockchain Interoperability

Wrapped assets like WBTC enabled Bitcoin to enter DeFi, but centralized custody and fragmentation make them a temporary fix. Native cross-chain tech is rising - and wrapped tokens may soon become obsolete.

- November 4 2025

- Terri DeLange

- 20 Comments

Cryptocurrency Mixing Services and North Korea's Money Laundering Tactics

Cryptocurrency mixing services help hide transaction trails, making them a key tool for North Korea’s cyber thefts. Learn how these tools work, why they’re hard to stop, and how law enforcement is fighting back.

- November 3 2025

- Terri DeLange

- 12 Comments

How Coin Burning Affects Cryptocurrency Prices

Coin burning reduces cryptocurrency supply, which can increase price-but only if the burn is meaningful, transparent, and backed by real project growth. Not all burns work. Here’s what actually moves the market.

- November 3 2025

- Terri DeLange

- 11 Comments

Countries Moving Away from Fiat to Digital Currency: CBDCs, Bitcoin, and the Real-World Shift

Thirteen-seven countries are building digital currencies, but only a few are getting it right. From the Bahamas' Sand Dollar to Nigeria's struggling e-Naira and El Salvador's Bitcoin experiment, here's how real-world adoption is playing out.

- October 28 2025

- Terri DeLange

- 13 Comments

Quanto Crypto Exchange Review: The Solana DEX That Lets You Trade Meme Coins as Collateral

Quanto is a Solana-based DEX that lets you trade perpetual contracts using meme coins and other volatile assets as collateral - no stablecoin conversion needed. Low fees, high leverage, and unique features make it powerful for retail traders.

- October 21 2025

- Terri DeLange

- 17 Comments

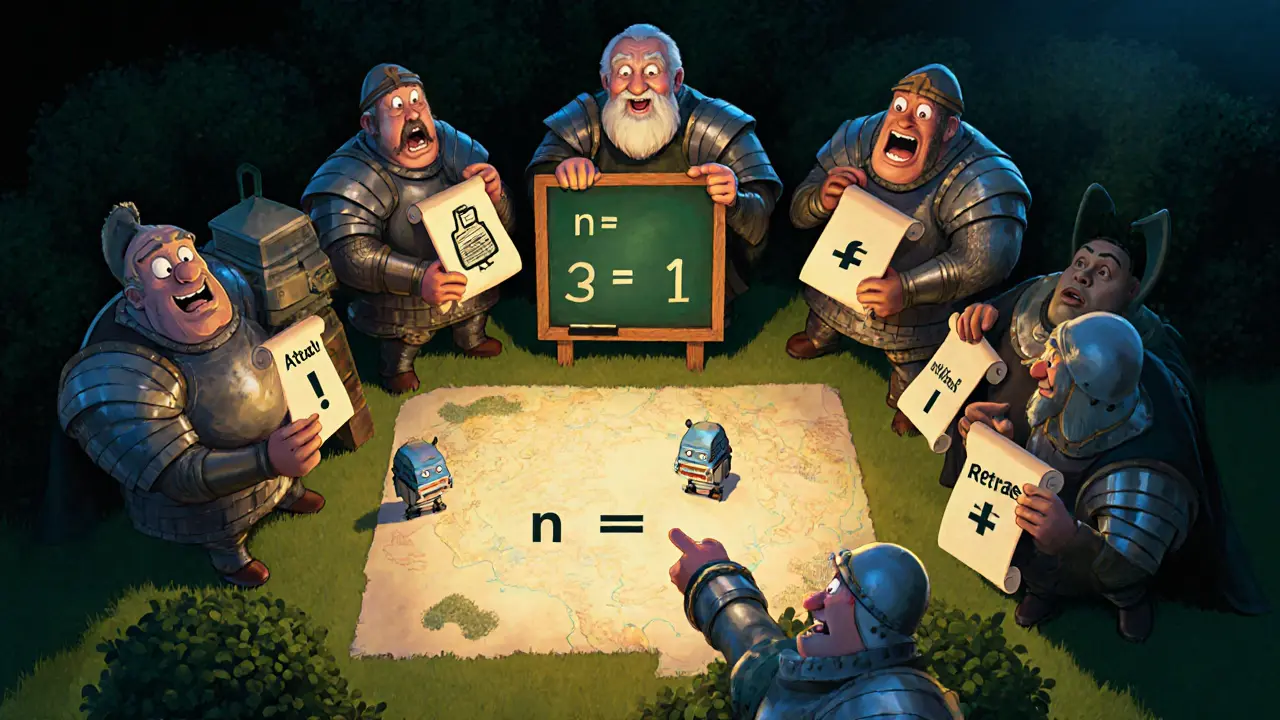

How Many Faulty Nodes Can BFT Systems Tolerate? The Math Behind Blockchain Consensus

BFT systems can tolerate up to one-third of nodes being faulty, governed by the formula n ≥ 3f + 1. Learn how many nodes you need to handle 1, 2, or 3 faults - and why running the minimum is often a dangerous mistake.

- October 20 2025

- Terri DeLange

- 10 Comments

Cryptographic Hashing vs Encryption in Blockchain: What You Actually Need to Know

Cryptographic hashing secures blockchain structure by verifying data integrity, while encryption proves ownership through digital signatures. Understanding both is key to using crypto safely.

- October 11 2025

- Terri DeLange

- 0 Comments

What is Yabba Dabba Doo! (YBDBD) crypto coin? The truth behind the meme coin

Yabba Dabba Doo! (YBDBD) is a memecoin with no team, no code, and no real utility. It's built on BSC, has no exchange listings, and shows classic signs of a scam. Don't invest.

- October 11 2025

- Terri DeLange

- 15 Comments