AUSTRAC Crypto Rules: What You Need to Know About Australia’s Crypto Regulations

When you buy, sell, or trade cryptocurrency in Australia, you’re dealing with AUSTRAC crypto rules, Australia’s financial intelligence agency that enforces anti-money laundering and counter-terrorism financing laws for digital assets. Also known as Australian Transaction Reports and Analysis Centre, it’s the body that makes sure crypto exchanges operating here follow strict reporting standards. If you’re using Binance, CoinSpot, or any other platform in Australia, they’re legally required to verify your identity, track your transactions, and report suspicious activity to AUSTRAC. This isn’t optional—it’s the law.

These rules don’t just apply to exchanges. They extend to anyone running a crypto service provider, a business that exchanges digital assets for fiat money or other cryptocurrencies. This includes wallet providers, peer-to-peer platforms, and even some DeFi interfaces if they handle user funds. If you’re operating one of these services in Australia, you must register with AUSTRAC, implement KYC checks, and keep records for seven years. Miss a step, and you could face fines or even criminal charges. The system isn’t just about catching criminals—it’s about making the entire crypto ecosystem transparent. That’s why AUSTRAC works closely with international agencies like FATCA, a U.S. law that forces foreign financial institutions to report account holders’ information. This global coordination means your crypto activity in Australia can trigger reporting in the U.S., Europe, or beyond. You’ll see this overlap in posts about MiCA, tax reporting, and cross-border crypto services—because AUSTRAC doesn’t operate in a vacuum. It’s part of a larger web of compliance that’s reshaping how crypto works everywhere.

What does this mean for you? If you’re an Australian trader, you’re not just buying Bitcoin—you’re participating in a regulated system. Every transaction you make through a licensed exchange is logged, flagged if unusual, and potentially reported to the ATO. That’s why posts here cover things like crypto tax reporting, exchange reviews for Australian users, and how to avoid scams that ignore AUSTRAC’s rules. You won’t find advice on using unregistered platforms—because those aren’t just risky, they’re illegal under Australian law.

The truth is, AUSTRAC crypto rules aren’t designed to stop innovation—they’re meant to protect it. By forcing platforms to be accountable, they help weed out fraudsters and give legitimate users confidence. That’s why the best exchanges in Australia, like those listed in our guides, are the ones that follow these rules transparently. You’ll find posts here explaining how to trade safely under these rules, how to report your crypto income, and how to spot platforms that are trying to bypass compliance. This isn’t bureaucracy—it’s the foundation for a trustworthy crypto future in Australia.

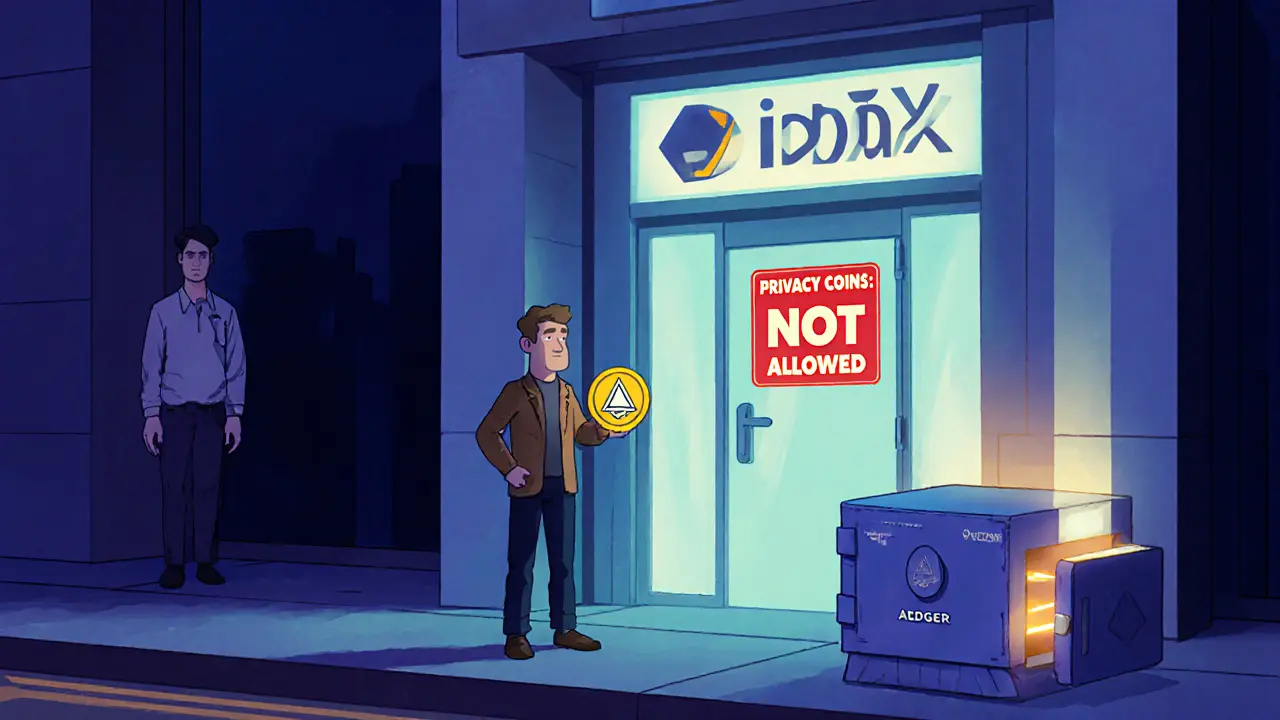

Privacy Coins Banned on Australian Crypto Exchanges: What You Need to Know

Australia has banned privacy coins like Monero and Zcash on licensed crypto exchanges due to AML rules. You can still own them, but trading them legally is nearly impossible. Here's what you need to know.

- January 13 2025

- Terri DeLange

- 15 Comments