Monero Ban: Why Privacy Coins Face Global Crackdowns

When you hear about a Monero ban, a privacy-focused cryptocurrency designed to hide transaction details from public blockchains. Also known as XMR, it's the most widely used coin that makes it impossible to trace who sent what to whom. Unlike Bitcoin, where every transaction is public, Monero uses ring signatures, stealth addresses, and confidential transactions to ensure no one—not even blockchain analysts—can see the sender, receiver, or amount. That’s why governments and financial regulators see it as a threat.

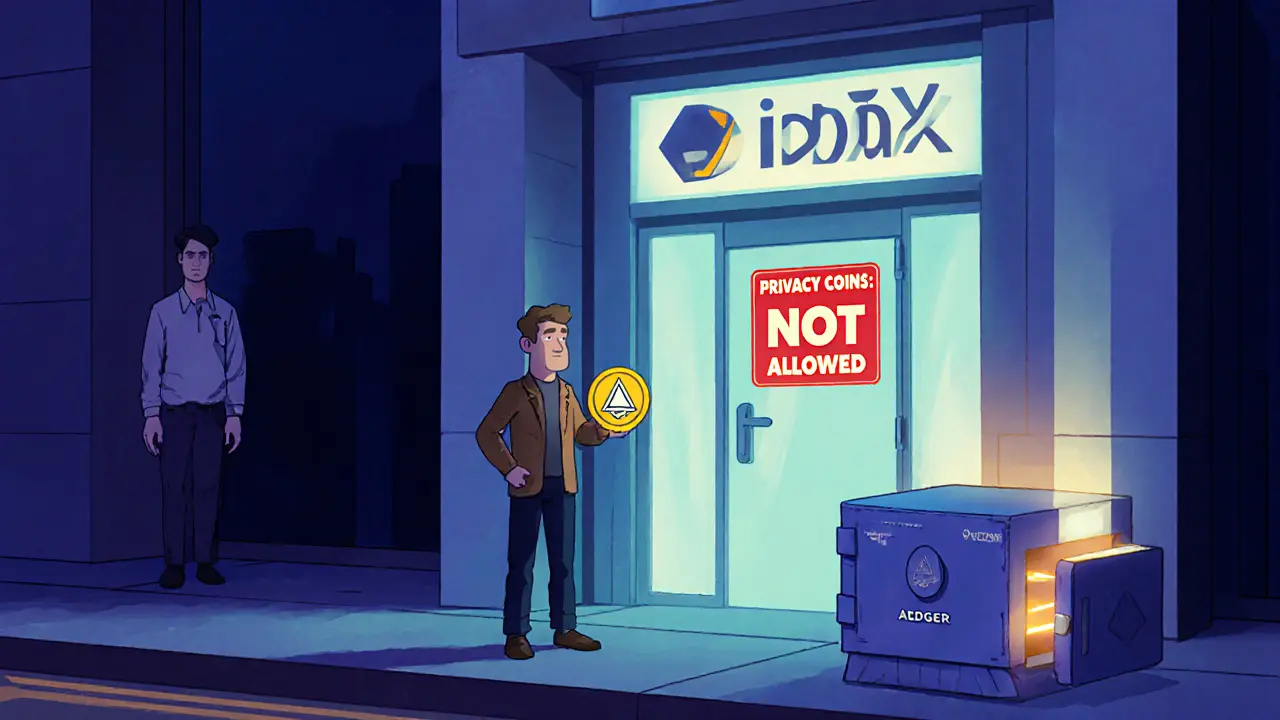

Regulators don’t ban Monero because it’s illegal—it’s legal everywhere. They ban it because it’s crypto regulation, government rules forcing exchanges and financial institutions to track and report user activity too strict for anonymous coins. Countries like Japan, South Korea, and parts of the EU have forced exchanges to delist Monero. The U.S. Treasury has flagged it as a high-risk asset. Even major platforms like Coinbase and Binance stopped supporting it. The goal? To stop money laundering, ransomware payments, and darknet markets. But the side effect? You lose control over your financial privacy.

Monero isn’t just a coin—it’s a privacy coin, a category of cryptocurrency built to protect user anonymity by design that challenges the entire model of financial surveillance. Other privacy coins like Zcash and Dash have tried to walk the line—offering optional privacy—but Monero made privacy mandatory. That’s why it’s still mined by thousands of ordinary people, not just criminals. Its network runs on consumer-grade hardware, and its community fights back with open-source code, not lobbyists. The Monero mining, the process of securing the Monero network using CPU and GPU power without specialized ASICs model is deliberately anti-centralized, making it hard for big players to take over.

What you’ll find in the posts below isn’t just news about bans. It’s the real story: how regulators are changing the rules, what exchanges are doing behind the scenes, and how people still use privacy coins despite the pressure. You’ll see how Monero’s tech compares to other blockchains, why some countries are more aggressive than others, and what happens when you try to hold XMR in a wallet that’s under scrutiny. This isn’t theory—it’s happening right now, in real time, and it affects every crypto user who values freedom over compliance.

Privacy Coins Banned on Australian Crypto Exchanges: What You Need to Know

Australia has banned privacy coins like Monero and Zcash on licensed crypto exchanges due to AML rules. You can still own them, but trading them legally is nearly impossible. Here's what you need to know.

- January 13 2025

- Terri DeLange

- 15 Comments